Question:

Michael Edwards, 43, is a recently divorced father of two children, ages 9 and 7. He currently earns $95,000 a year as an operations manager for a utility company. The divorce settlement requires him to pay $1,500 a month in child support and $400 a month in alimony to his ex-wife. Michael is now renting an apartment, and the divorce settlement left him with about $100,000 in savings and retirement benefits. His employer provides a $75,000 life insurance policy. Michael’s ex-wife is currently the beneficiary listed on the policy. What advice would you give to Michael? What factors should he consider in deciding whether to buy additional life insurance at this point in his life? If he does need additional life insurance, what type of policy or policies should he buy? Help answer these questions for Michael.

Transcribed Image Text:

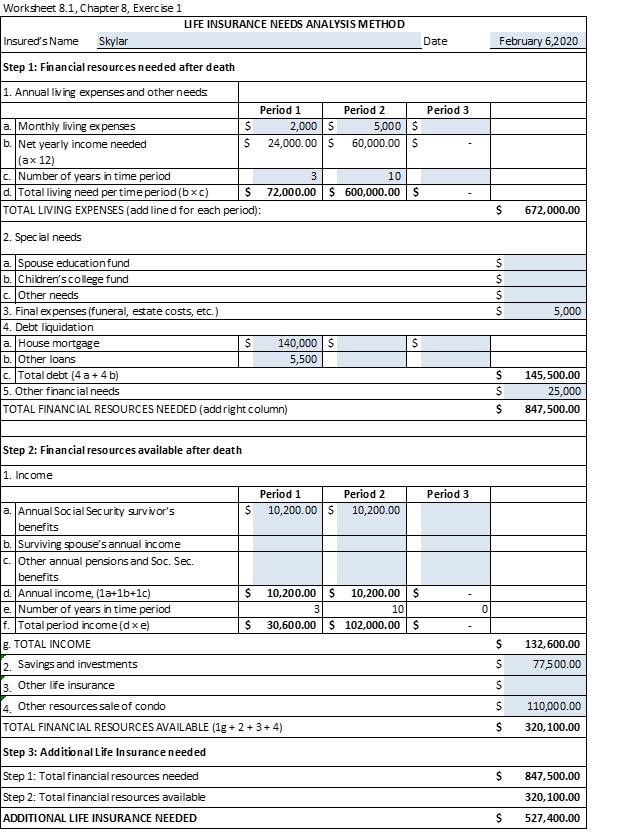

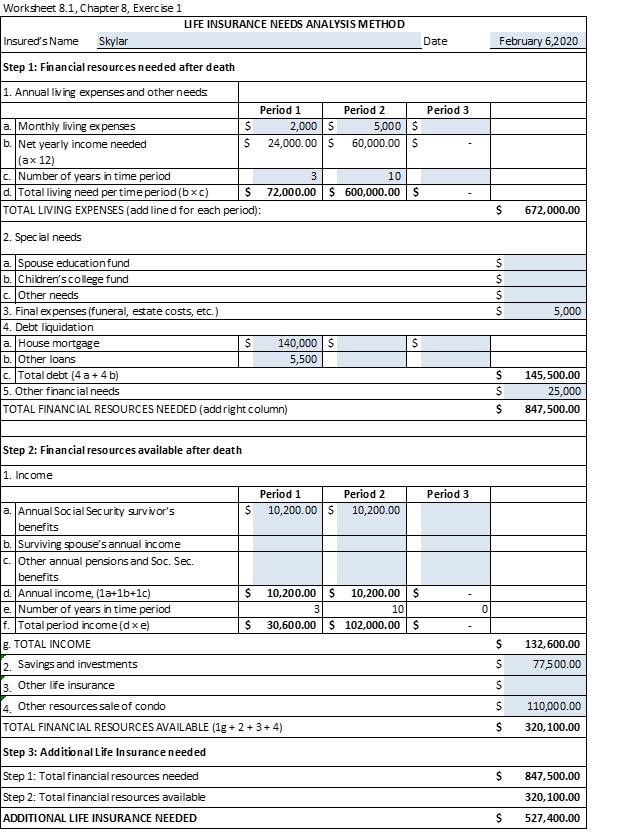

Worksheet 8.1, Chapter 8, Exercise 1

Insured's Name Skylar

Step 1: Financial resources needed after death

1. Annual living expenses and other needs

a. Monthly living expenses

b. Net yearly income needed

(ax 12)

LIFE INSURANCE NEEDS ANALYSIS METHOD

2. Special needs

a. Spouse education fund

b. Children's college fund

c. Other needs

c. Number of years in time period

$

d. Total living need per time period (bxc)

TOTAL LIVING EXPENSES (add lined for each period):

Step 2: Financial resources available after death

1. Income

a. Annual Social Security survivor's

benefits

3. Final expenses (funeral, estate costs, etc.)

4. Debt liquidation

a. House mortgage

b. Other loans

c. Total debt (4 a + 4 b)

5. Other financial needs

TOTAL FINANCIAL RESOURCES NEEDED (add right column)

b. Surviving spouse's annual income

c. Other annual pensions and Soc. Sec.

benefits

d. Annual income, (la+1b+1c)

e. Number of years in time period

f. Total period income (dxe)

g. TOTAL INCOME

2. Savings and investments

$

2,000 $

$ 24,000.00 $

Period 1

Step 3: Additional Life Insurance needed

Step 1: Total financial resources needed

Step 2: Total financial resources available

ADDITIONAL LIFE INSURANCE NEEDED

$

$

3

10

72,000.00 $ 600,000.00 $

140,000 $

5,500

Period 1

10,200.00 $

Period 2

3. Other life insurance

4. Other resources sale of condo

TOTAL FINANCIAL RESOURCES AVAILABLE (1g+2+3+4)

5,000 $

60,000.00 $

Period 2

10,200.00

$

$ 10,200.00 $

3

10

$ 30,600.00 $ 102,000.00 $

10,200.00 $

Date

Period 3

Period 3

February 6,2020

$ 672,000.00

$

$

$

$

$

$

$

$

$

$

$

$

$

$

5,000

145,500.00

25,000

847,500.00

132,600.00

77,500.00

110,000.00

320,100.00

847,500.00

320,100.00

527,400.00