Sadie Richardsons banker has asked her to submit a personal balance sheet as of June 30, 2020,

Question:

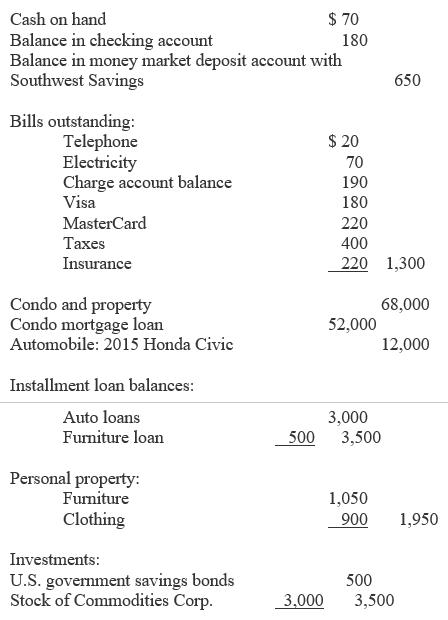

Sadie Richardson’s banker has asked her to submit a personal balance sheet as of June 30, 2020, in support of an application for a $6,000 home improvement loan. She comes to you for help in preparing it. So far, she has made the following list of her assets and liabilities as of June 30, 2020:

From the data given, prepare Sadie Richardson’s balance sheet, dated June 30, 2020. Then evaluate her balance sheet relative to the following factors: (a) solvency, (b) liquidity, and (c) equity in her dominant asset.

a. Solvency Ratio: This term refers to having a positive net worth. The calculation for her solvency ratio is as follows

b. Liquidity Ratio: A simple analysis of Sadie’s balance sheet reveals that she's not very liquid. In comparing current liquid assets ($900) with current bills outstanding ($1,300), it is obvious that she cannot cover her bills and is, in fact, $400 short (i.e., $1,300 current debt – $900 current assets). Her liquidity ratio is

c. Equity in Her Dominant Asset: Sadie’s dominant asset is her condo and property, which is currently valued at $68,000. Since the loan outstanding on this asset is $52,000, the equity is $16,000 (i.e., $68,000 – $52,000). This amount indicates about a 24% equity interest (i.e., $16,000/$68,000) in the market value of her real estate. This appears to be a favorable equity position. However, if Sadie was forced to sale the condo to pay other debt, the selling costs could be 15% of sales price and the distressed sale price could wipe out the balance of her equity

Step by Step Answer:

Personal Financial Planning

ISBN: 9780357438480

15th Edition

Authors: Randy Billingsley, Lawrence J. Gitman, Michael D. Joehnk