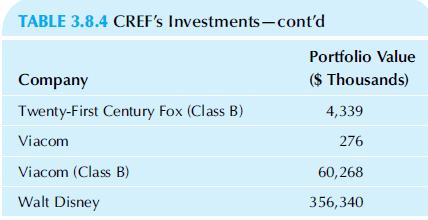

Question: Using the data from Table 3.8.4 in Chapter 3, for the market values of the portfolio investments of the College Retirement Equities Growth Fund in

Using the data from Table 3.8.4 in Chapter 3, for the market values of the portfolio investments of the College Retirement Equities Growth Fund in the media sector:

a. Find the average market value for these firms’ stock in CREF’s Growth Fund portfolio.

b. Find the median of these market values.

c. Compare the average to the median.

d. Find the five-number summary.

e. Draw a box plot, and comment on the distribution shape. In particular, are there any signs of skewness?

f. Is the relationship between the average and median consistent with the distribution shape? Why or why not?

TABLE 3.8.4 CREF's Investments-cont'd Portfolio Value Company ($ Thousands) Twenty-First Century Fox (Class B) 4,339 Viacom 276 Viacom (Class B) 60,268 Walt Disney 356,340

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

a The average is 37278900 because the values in the table ... View full answer

Get step-by-step solutions from verified subject matter experts