Question: When the Internal Revenue Service (IRS) tax code was revised in 1986, Congress granted some special exemptions to specific corporations. The U.S. governments revenue losses

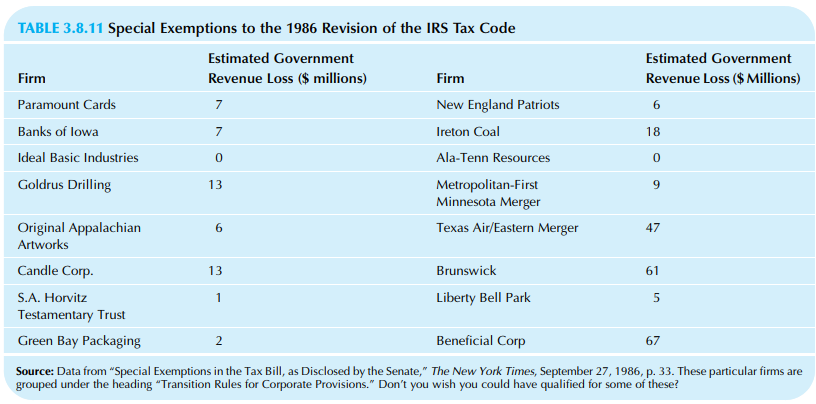

When the Internal Revenue Service (IRS) tax code was revised in 1986, Congress granted some special exemptions to specific corporations. The U.S. government’s revenue losses due to some of these special transition rules for corporate provisions are shown in Table 3.8.11.

a. Construct a histogram for this data set.

b. Describe the distribution shape.

TABLE 3.8.11 Special Exemptions to the 1986 Revision of the IRS Tax Code Estimated Government Estimated Government Revenue Loss ($ millions) Revenue Loss ($ Millions) Firm Firm Paramount Cards New England Patriots Banks of lowa Ireton Coal 18 Ideal Basic Industries Ala-Tenn Resources Goldrus Drilling Metropolitan-First Minnesota Merger 13 Original Appalachian Artworks Texas Air/Eastern Merger 47 Candle Corp. Brunswick 13 61 Liberty Bell Park S.A. Horvitz Testamentary Trust Green Bay Packaging Beneficial Corp 67 Source: Data from "Special Exemptions in the Tax Bill, as Disclosed by the Senate," The New York Times, September 27, 1986, p. 33. These particular firms are grouped under the heading "Transition Rules for Corporate Provisions." Don't you wish you could have qualified for some of these?

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

a b The distribution is skewed toward high values a... View full answer

Get step-by-step solutions from verified subject matter experts