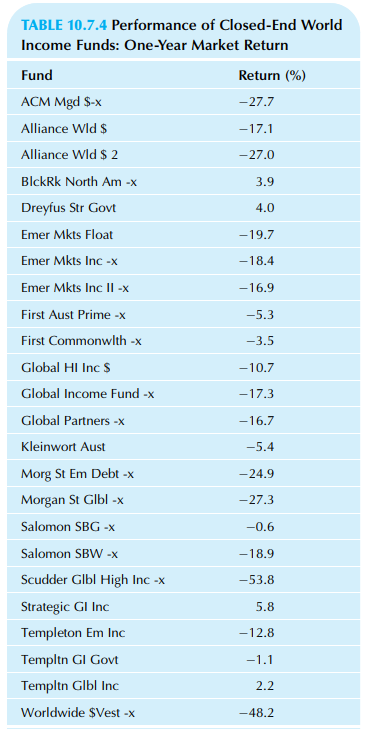

World investments markets were highly volatile in 1998. Table 10.7.4 shows one-year rates of return on closedend

Question:

World investments markets were highly volatile in 1998. Table 10.7.4 shows one-year rates of return on closedend mutual funds that specialize in income from international sources.

a. Do the rates of return of these closed-end world income funds, as a group, differ significantly on average from the 2.59% overall performance representing all world mutual funds over the same time period? If so, were these closed-end funds significantly better or significantly worse? In your calculations, you may assume that the overall performance is measured without randomness.

b. Do the rates of return of these closed-end world income funds, as a group, differ significantly on average from the 26.83% overall performance representing all emerging markets’ mutual funds over the same time period? If so, were these closed-end funds significantly better or significantly worse? In your calculations, you may assume that the overall performance is measured without randomness.

Mutual funds are like a pool of funds gathered by different small investors that have simalar investment perspective about returns on their investments. These funds are managed by professional investment managers who act smartly on behalf of the...

Step by Step Answer: