During his stay in Switzerland in 2017, when he was about to finish his MBA, Sanjay Menon

Question:

During his stay in Switzerland in 2017, when he was about to finish his MBA, Sanjay Menon had the idea of starting a new business back home in India. At several European airports, he had seen some vending machines selling electronics (such as iPods) rather than soft drinks or other inexpensive products. He thought that importing and selling those new-generation vending machines in India could be a good idea, especially when some of his relatives were already involved in the industry.

However, Sanjay did not have much money, so he showed his business plan to his rich uncle Anoop Patnaik, with the aim of involving him in the new firm as the main shareholder. Anoop agreed to invest in the business, so they both went ahead and made a bank deposit of \($120,000\) (Sanjay invested \($20,000\), his uncle \($100,000)\) as equity for the new firm. Additionally, at the end of the year, they took out a bank loan (\($40,000\), 10 percent per year) to avoid potential cash tension.

On December 30, they bought a small warehouse to store the machines for \($100,000\) (\($40,000\) land, \($60,000\) building). Sanjay paid \($80,000\) cash; the remaining amount was agreed to be paid on December 30 the following year. Both shareholders estimated the life of the warehouse to be an additional twenty years.

The same day, Anoop bought some furniture necessary to run the business, paying \($4,000\) cash, with an estimates life of five years.

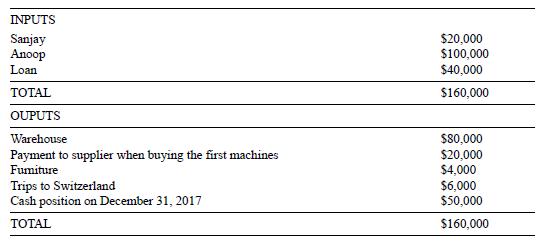

The last day of the year, Sanjay and Anoop met to assess the situation of the firm. No machines had been sold yet. Sanjay had prepared the cash report shown below.

Sanjay also mentioned that there were twenty machines in the warehouse, whose total cost had been \($2,000\) each.

Anoop read the report and told Sanjay that the information was insufficient. He then asked for the balance sheet of the firm (December 31, 2017). Sanjay did not know exactly how to prepare it, but did his best.

During 2018, Sanjay was in charge of the business, taking care of cash flows (i.e., cash inputs and outputs), but not really paying attention to the financial situation of the firm. Time went by quickly. At the beginning of December 2018, Sanjay got an e-mail from his uncle requiring the following information for year 2018:

• Balance sheet (December 31)

• Income statement • Statement of cash flows Sanjay gathered all the information he was able to find regarding operations during 2018 and summarized it as follows:

1. The firm imported 150 machines (on account, i.e., using trade credit) at \($2,000\) each.

2. Fifty machines were sold (cash) at \($3,000\) each.

3. One hundred machines were sold (on account) at \($3,300\) each.

4. During 2018, \($250,000\) was collected from customers who had not paid cash.

5. Likewise, the firm paid the cost of 140 machines to the supplier.

6. General and administrative expenses totaled \($20,000\) (cash).

7. The remaining money corresponding to the warehouse was paid.

8. On Dec 31, 2018, the bank debt was repaid.

9. Interest of the loan was paid.

a. Prepare the balance sheet as of Dec 31, 2017.

b. Prepare the balance sheet as of Dec 31, 2018.

c. Prepare the income statement for 2018.

Step by Step Answer:

Practical Finance For Operations And Supply Chain Management

ISBN: 9780262043595

1st Edition

Authors: Alejandro Serrano, Spyros D. Lekkakos, James B. Rice