The management of Green Staples Inc., a wholesale distributor of office supplies on the East Coast of

Question:

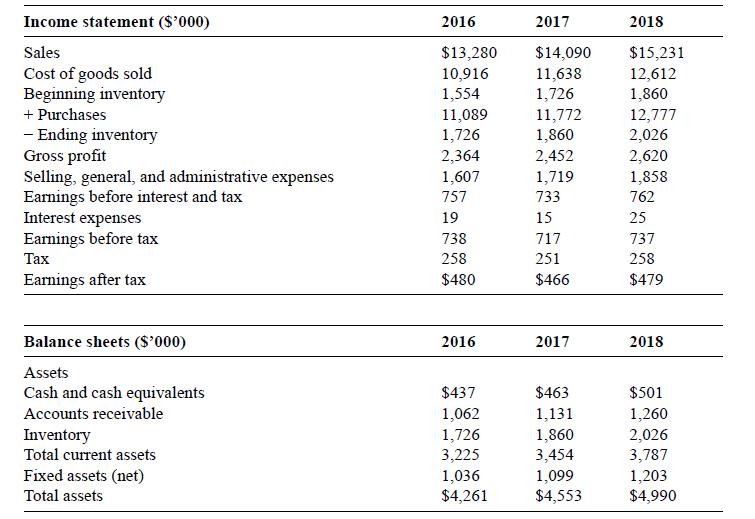

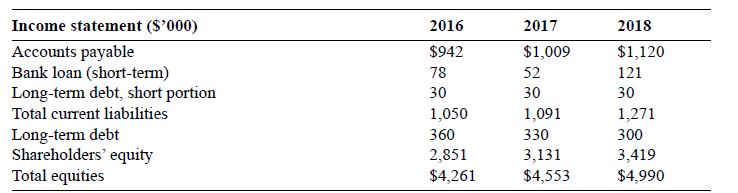

The management of Green Staples Inc., a wholesale distributor of office supplies on the East Coast of the United States, is in the process of developing the firm’s financial plans for year 2019. The company has met its goal of expanding its market coverage, having increased its 2018 sales by 8.1 percent, a growth much higher than the industry average. The management believes that 2019 will bring opportunities for further expansion, as one of the local key players is preparing to exit the market (due to the owner’s retirement). However, they also understand that they need to secure in advance the necessary financing sources in order to prudently meet the new target of 11 percent sales growth in 2019. The following charts show the company’s year-end financial statements for the last three years.

a. Construct the firm’s statement of cash flows and compute its basic ratios. What can you infer about the firm’s historical performance? Are there any ratios that require management’s attention? Please explain briefly.

b. What is your guess about the firm’s short-term debt needs to support its 2019 growth target? To answer this question, please assume that Green Staples Inc. does not intent to change its earnings retention policy and has no access to shareholder equity or long-term debt (due to covenants from the current debt-holders).

Step by Step Answer:

Practical Finance For Operations And Supply Chain Management

ISBN: 9780262043595

1st Edition

Authors: Alejandro Serrano, Spyros D. Lekkakos, James B. Rice