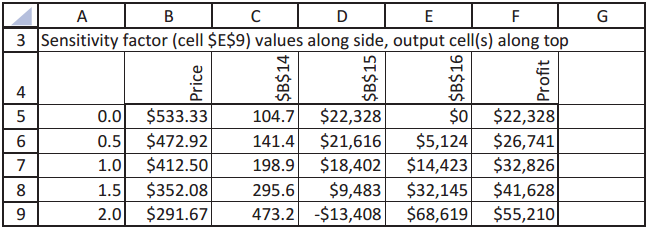

Question: In the complementary-product pricing model in Example 7.3, the SolverTable results in Figure 7.21 indicate that the company can sometimes increase overall profit by selling

In the complementary-product pricing model in Example 7.3, the SolverTable results in Figure 7.21 indicate that the company can sometimes increase overall profit by selling suits below cost. How far might this behavior continue? Answer by extending the SolverTable to larger values of the sensitivity factor, so that more and more shirts and ties are being purchased per suit. Does there appear to be a lower limit on the price that should be charged for suits? Might it reach a point where the company gives them away?

Figure 7.21:

D 3 Sensitivity factor (cell $E$9) values along side, output cell(s) along top 4 $22,328 0.0 $533.33 $22,328 $21,616 $18,402 5 104.7 $0 $26,741 $32,826 $5,124 $14,423 $472.92 141.4 198.9 295.6 473.2 -$13,408 $68,619 $55,210| 0.5 1.0 $412.50 $32,145 $41,628| $352.08 $9,483 1.5 $291.67 2.0 Price $B$14 $B$15 8 $B$16 Profit

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Model Pricing complementary products Suits Complementary products Current price 350 Ties Shirts Curr... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1497_607ef2a9c13d0_690531.xlsx

300 KBs Excel File