Assume that Wilson Paper funds its capital spending out of its estimated full year earnings. If Wilson

Question:

Assume that Wilson Paper funds its capital spending out of its estimated full year earnings. If Wilson uses a residual dividend policy, determine Wilson’s implied dividend payout ratio:

A. 36%.

B. 40%.

C. 60%.

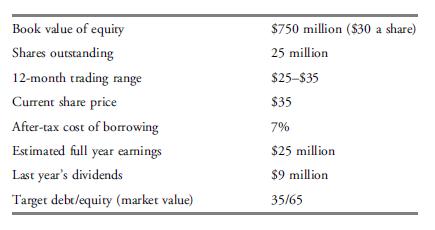

Janet Wu is treasurer of Wilson Paper Company, a manufacturer of paper products for the office and school markets. Wilson Paper is selling one of its divisions for \($70\) million cash. Wu is considering whether to recommend a special dividend of \($70\) million or a repurchase of 2 million shares of Wilson common stock in the open market. She is reviewing some possible effects of the buyback with the company’s financial analyst. Wilson has a long-term record of gradually increasing earnings and dividends. Wilson’s board has also approved capital spending of \($15\) million to be entirely funded out of this year’s earnings.

Step by Step Answer:

Corporate Finance A Practical Approach

ISBN: 9781118217290

2nd Edition

Authors: Michelle R Clayman, Martin S Fridson, George H Troughton, Matthew Scanlan