Consider the following two projects: a. If the opportunity cost of capital is 11%, which of these

Question:

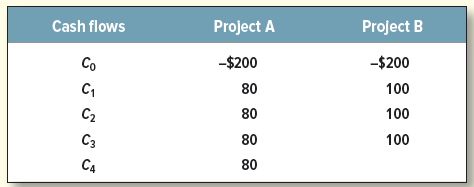

Consider the following two projects:

a. If the opportunity cost of capital is 11%, which of these two projects would you accept (A, B, or both)?

b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 11%.

c. Which one would you choose if the cost of capital is 16%?

d. What is the payback period of each project?

e. Is the project with the shortest payback period also the one with the highest NPV?

f. What are the internal rates of return on the two projects?

g. Does the IRR rule in this case give the same answer as NPV?

h. If the opportunity cost of capital is 11%, what is the profitability index for each project? Is the project with the highest profitability index also the one with the highest NPV? Which measure should you use to choose between the projects?

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-1260013900

13th edition

Authors: Richard Brealey, Stewart Myers, Franklin Allen