Plot the NPVs for the following projects for discount rates from 0% to 30%: a. Which one

Question:

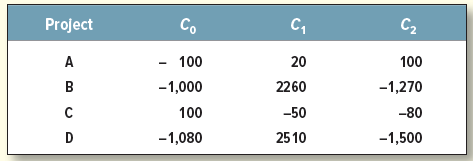

Plot the NPVs for the following projects for discount rates from 0% to 30%:

a. Which one of these projects has no IRR?

b. One of the projects has two IRRs. Which is this project and what are the IRRs?

c. What are the IRRs of the other two projects?

d. Suppose projects A and C are mutually exclusive. If the cost of capital is 6%, which one would you accept?

e. If the cost of capital is very high, would you accept project C? Why or why not?

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles of Corporate Finance

ISBN: 978-1260013900

13th edition

Authors: Richard Brealey, Stewart Myers, Franklin Allen

Question Posted: