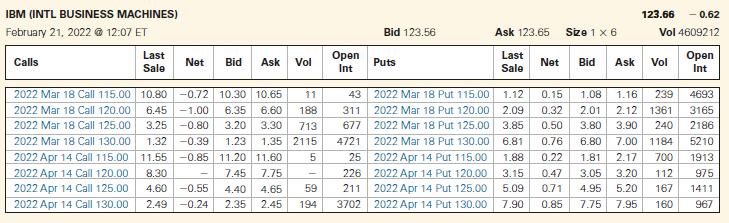

Consider the IBM call and put options in Problem 3. IBM paid a dividend on February 10,

Question:

Consider the IBM call and put options in Problem 3. IBM paid a dividend on February 10, 2022, and was not scheduled to pay another dividend until May 2022. Ignoring the negligible interest you might earn on T-bills over the remaining few days’ life of the options, show that there is no arbitrage opportunity using put-call parity for the February options with a $115 strike price. Specifically:

a. What is your profit/loss if you buy a call and T-bills, and sell IBM stock and a put option?

b. What is your profit/loss if you buy IBM stock and a put option, and sell a call and T-bills?

c. Explain why your answers to (a) and (b) are not both zero.

d. Do the same calculation for the April options with a strike price of $125. What do you find?

How can you explain this?

Data from in problem 3

Below is an option quote on IBM from the CBOE Web site showing options expiring in March and April 2022.

a. Which option contract had the most trades on that day?

b. Which option contract is being held the most overall?

c. Suppose you purchase one March 125 Call option. How much will you need to pay your broker for the option (ignoring commissions)?

d. Explain why the last sale price is not always between the bid and ask prices.

e. Suppose you sell one March 125 Put option. How much will you receive for the option (ignoring commissions)?

f. The calls with which strike prices are currently in-the-money? Which puts are in-the-money?

g. What is the difference between the March 115 Call option and the April 115 Call option?

Why is the second option more valuable?

h. On what date does the March 115 Call option expire? In what range must IBM’s stock price be at expiration for this option to be valuable?

Step by Step Answer: