Question: Consider the same setting as Problem 18, but suppose instead 80% of the shareholders redeem their shares, and no warrants are exercised. Data from problem

Consider the same setting as Problem 18, but suppose instead 80% of the shareholders redeem their shares, and no warrants are exercised.

Data from problem 18

a. What is the amount of cash per share contributed by the SPAC in that case?

b. If the target is offered 300 million shares, what is the implied valuation of the combined company in this case?

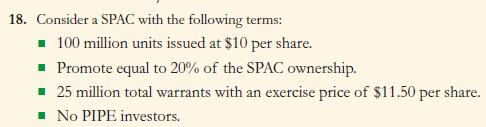

18. Consider a SPAC with the following terms: 100 million units issued at $10 per share. Promote equal to 20% of the SPAC ownership. 25 million total warrants with an exercise price of $11.50 per share. No PIPE investors.

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

a To determine the amount of cash per share contributed by the SPAC we need to calculate the ... View full answer

Get step-by-step solutions from verified subject matter experts