At HeÌbert Company, the following errors were discovered after the transactions had been journalized and posted: 1.

Question:

1. A collection of cash on account from a customer for $750 was recorded as a debit to Cash of $750 and a credit to Service Revenue of $750.

2. An invoice to a customer for $600 of services that were performed on account was recorded as a $600 debit to Accounts Receivable and a $600 credit to Unearned Revenue.

3. A $500 cash payment to the owner, Roch HeÌbert, was recorded as a debit to Salary Expense of $500 and a credit to Cash of $500.

4. The payment of cash to a creditor of $280 was recorded as a $280 credit to Accounts Payable and a $280 debit to Cash.

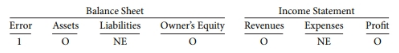

Indicate the impact of each error on the balance sheet and income statement by stating whether assets, liabilities, owner€™s equity, revenues, expenses, and profit are understated (U), overstated (O), or if there is no effect (NE). Use the following format, in which the answer for the first error is given as an example:

Accounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Principles Of Financial Accounting

ISBN: 9781118757147

1st Canadian Edition

Authors: Jerry J. Weygandt, Michael J. Atkins, Donald E. Kieso, Paul D. Kimmel, Valerie Ann Kinnear, Barbara Trenholm, Joan E. Barlow