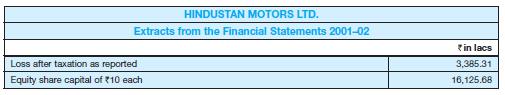

In Chapter 15 you were exposed to details of Non-provisioning of Expenses and Doubtful/Disputed Debts by Hindustan

Question:

In Chapter 15 you were exposed to details of Non-provisioning of Expenses and Doubtful/Disputed Debts by Hindustan Motors Ltd., explanations thereon in the notes to accounts, their treatment in the auditors’ report and stand of the directors in their report.

In this chapter you have been provided the summary details of those non-provisions. The following information is also being provided.

Required

1. Recompute the loss after making provisions not made. Tax Rate for A/Y 2002–03 ... 35.70%.

2. Compute the EPS as per reported loss.

3. Recompute the EPS after provisionings done by you in requirement 1.

4. Now study the reasons provided for non-provisioning in Chapter 15 and opine whether the reasons are justified? Assess the real motive behind non-provisioning.

5. Can you make a reasonable estimate of doubtful debts to be provided based on the information available? If yes, adjust your recomputed EPS. Measure the difference.

6. Do you think that this is a classic example of window dressing? Why or why not?

7. Draft a crisp two-page report.

Step by Step Answer: