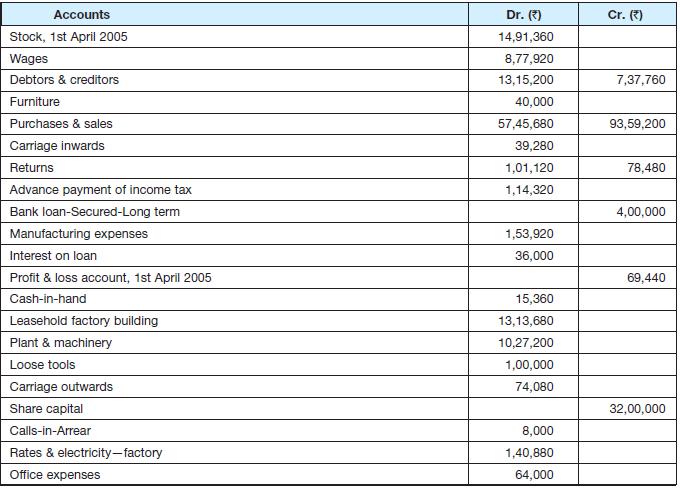

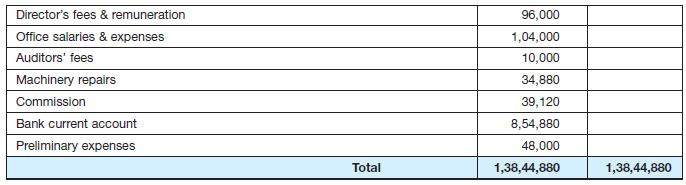

The following is the trial balance of Sangeeta Udhyog Ltd. as on 31st March 2006. Further information

Question:

The following is the trial balance of Sangeeta Udhyog Ltd. as on 31st March 2006.

Further information 1. The authorised share capital of the company consists of 4,00,000 equity shares of ` 10 each.

2. The stock was valued at ₹9,98,720 and loose tools at ` 80,000.

3. Wages ₹15,120 and office salaries ₹9,600 are due.

4. Bank loan was taken on 1-04-2005 on interest @ 15% p.a.

5. Depreciation is to be provided on:

1. Plant & Machinery @ 14%;

2. Furniture @ 18%.

6. Write off one-third Preliminary Expenses.

7. Provide ₹68,000 on Debtors for Doubtful Debts.

8. Provide further ₹24,960 for discount on debtors.

9. Make a provision for income tax @ 35%.

10. Transfer 10% of net profits to General Reserve.

11. The Directors recommend dividend @ 10% per annum for the year ended 31st March 2006.

Required 1. Prepare the following financial statements of Sangeeta Udhyog Ltd.:

a. Profit and loss account for the year ended 31st March 2006.

b. Profit and loss appropriation account for the year ended 31st March 2006.

c. Balance sheet as on 31st March 2006.

2. Briefly comment upon the performance of the company.

Step by Step Answer: