The July transactions of Acorn Industries are described in Problem 7-2B. Problem 7-2B, Acorn Industries completes these

Question:

The July transactions of Acorn Industries are described in Problem 7-2B.

Problem 7-2B,

Acorn Industries completes these transactions during July of the current year (the terms of all its credit sales are 2/10, n/30).

July 1 Purchased $6,500 of merchandise on credit from Teton Company, invoice dated June 30, terms 2/10, n/30.

3 Issued Check No. 300 to The Weekly for advertising expense, $625.

5 Sold merchandise on credit to Kim Nettle, Invoice No. 918, for $19,200 (cost is $10,500).

6 Sold merchandise on credit to Ruth Blake, Invoice No. 919, for $7,500 (cost is $4,300).

7 Purchased $1,250 of store supplies on credit from Plaine, Inc., invoice dated July 7, terms n/10 EOM.

8 Received a $250 credit memorandum from Plaine, Inc., for the return of store supplies received on July 7.

9 Purchased $38,220 of store equipment on credit from Charm's Supply, invoice dated July 8, terms n/10 EOM.

10 Issued Check No. 301 to Teton Company in payment of its June 30 invoice less the discount.

13 Sold merchandise on credit to Ashton Moore, Invoice No. 920, for $8,550 (cost is $5,230).

14 Sold merchandise on credit to Kim Nettle, Invoice No. 921, for $5,100 (cost is $3,800).

15 Received payment from Kim Nettle for the July 5 sale less the discount.

15 Issued Check No. 302, payable to Payroll, in payment of sales salaries expense for the first half of the month, $31,850. Cashed the check and paid employees.

15 Cash sales for the first half of the month are $118,350 (cost is $76,330). (Cash sales are recorded daily using data from the cash registers but are recorded only twice in this problem to reduce repetitive entries.) 16 Received payment from Ruth Blake for the July 6 sale less the discount.

17 Purchased $7,200 of merchandise on credit from Drake Company, invoice dated July 17, terms 2/10, n/30.

20 Purchased $650 of office supplies on credit from Charm's Supply, invoice dated July 19, terms n/10 EOM.

21 Borrowed $15,000 cash from College Bank by signing a long-term note payable.

23 Received payment from Ashton Moore for the July 13 sale less the discount.

24 Received payment from Kim Nettle for the July 14 sale less the discount.

24 Received a $2,400 credit memorandum from Drake Company for the return of defective merchandise received on July 17.

26 Purchased $9,770 of merchandise on credit from Teton Company, invoice dated July 26, terms 2/10, n/30.

27 Issued Check No. 303 to Drake Company in payment of its July 17 invoice less the return and the discount.

29 Sold merchandise on credit to Ruth Blake, Invoice No. 922, for $17,500 (cost is $10,850).

30 Sold merchandise on credit to Ashton Moore, Invoice No. 923, for $16,820 (cost is $9,840).

31 Issued Check No. 304, payable to Payroll, in payment of the sales salaries expense for the last half of the month, $31,850.

31 Cash sales for the last half of the month are $80,244 (cost is $53,855).

Required

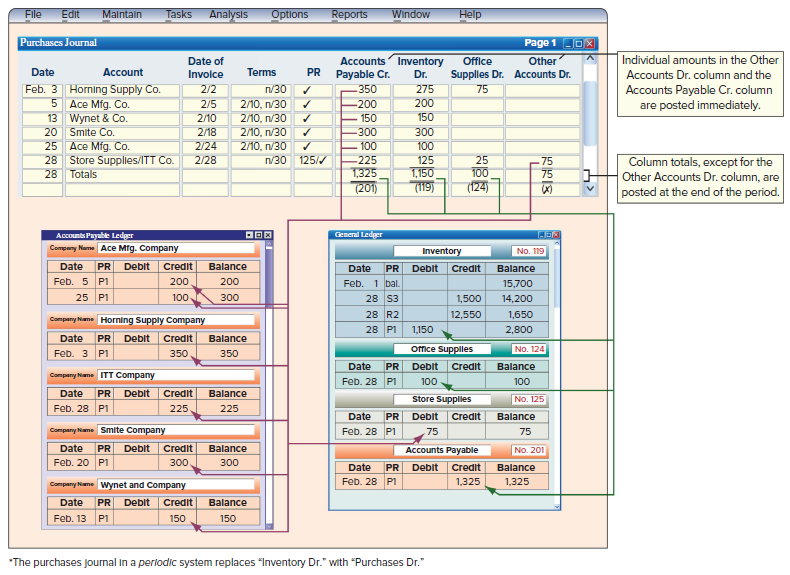

1. Prepare a general journal, a purchases journal like that in Exhibit 7.9, and a cash disbursements journal like that in Exhibit 7.11. Number all journal pages as page 3. Review the July transactions of Acorn Industries and enter those transactions that should be journalized in the general journal, the purchases journal, or the cash disbursements journal. Ignore any transactions that should be journalized in a sales journal or cash receipts journal.

EXHIBIT 7.9: Purchases Journal with Posting

2. Open the following general ledger accounts: Cash; Inventory; Office Supplies; Store Supplies; Store Equipment; Accounts Payable; Long-Term Notes Payable; R. Acorn, Capital; Sales Salaries Expense; and Advertising Expense. Enter the June 30 balances of Cash ($100,000), Inventory ($200,000), Long-Term Notes Payable ($200,000), and R. Acorn, Capital ($100,000). Also open accounts payable subsidiary ledger accounts for Charm’s Supply, Teton Company, Drake Company, and Plaine, Inc.

3. Verify that amounts that should be posted as individual amounts from the journals have been posted. (Such items are immediately posted.) Foot and cross foot the journals and make the month end postings.

4. Prepare a trial balance of the general ledger accounts opened as required for part 2; then prepare a schedule of accounts payable.

Step by Step Answer:

Principles of Financial Accounting chapters 1-17

ISBN: 978-1259687747

23rd edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta