After careful analysis, Rumi Builders has determined that its optimal capital structure is composed of the sources

Question:

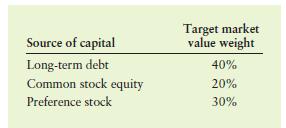

After careful analysis, Rumi Builders has determined that its optimal capital structure is composed of the sources and target market value weights shown in the following table.

The cost of debt is 5%, the cost of preferred stock is 12%, and the cost of new common stock is 8%. All financing costs are after-tax rates. The company’s debt represents 30%, the preferred stock represents 60%, and the common stock equity represents 10% of total capital on the basis of the current market values of the three components.

a. Calculate the WACC based on historical market value weights.

b. Calculate the WACC based on target market value weights.

c. Compare the answer obtained in parts a and b. Explain the differences

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart