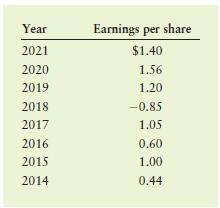

Alternative dividend policies Given the earnings per share over the period 2014 2021 shown in the following

Question:

Alternative dividend policies Given the earnings per share over the period 2014– 2021 shown in the following table, determine the annual dividend per share under each of the policies set forth in parts a through d.

a. Pay out 50% of earnings in all years with positive earnings.

b. Pay $0.50 per share and increase to $0.60 per share whenever earnings per share rise above $0.90 per share for two consecutive years.

c. Pay $0.50 per share except when earnings exceed $1.00 per share, in which case pay an extra dividend of 60% of earnings above $1.00 per share.

d. Combine the policies described in parts b and c. When the dividend is raised (in part b), raise the excess dividend base (in part c) from $1.00 to $1.10 per share.

e. Compare and contrast each of the dividend policies described in parts a through d.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart