As a financial analyst for your company, you have been asked to calculate the discounted payback period

Question:

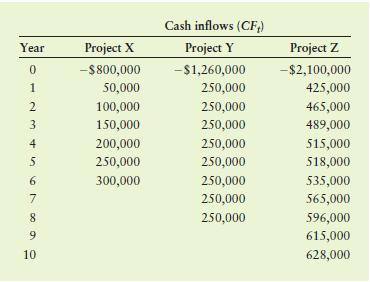

As a financial analyst for your company, you have been asked to calculate the discounted payback period for the following projects and recommend whether your firm should accept or reject each project. Your firm’s cost of capital is 7.8% and your firm uses a maximum allowable payback period of six years. The cash flows associated with each project are shown in the following table.

a. What is the discounted payback period of each project?

b. Which projects should the company invest in based on the maximum allowable payback period?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart

Question Posted: