BP is evaluating an unusual investment project. What makes the project unusual is the stream of cash

Question:

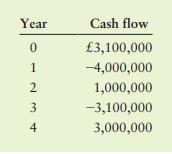

BP is evaluating an unusual investment project. What makes the project unusual is the stream of cash inflows and outflows shown in the following table.

a. Why is it difficult to calculate the payback period for this project?

b. Calculate the investment’s net present value (NPV) at each of the following discount rates: 0%, 5%, 10%, 15%, 20%, 25%, 30%, and 35%.

c. What does your answer to part b tell you about this project’s internal rate of return (IRR)?

d. Should BP invest in this project if its cost of capital is 6%? What if the cost of capital is 12%?

e. In general, when faced with investment projects like this one, how should a firm decide whether to invest in the project or reject it?

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart