Apart from opening a new store in Sydney, Woolworths Ltd. is also considering opening a store in

Question:

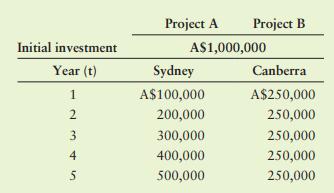

Apart from opening a new store in Sydney, Woolworths Ltd. is also considering opening a store in Canberra. Like the Sydney store, this store will have the same initial cost of A$1,000,000. The company must now decide which store to invest in: Sydney or Canberra. The cash flows associated with each proposed store are shown in the following table.

a. Calculate the payback period for each proposed store.

b. Calculate the net present value (NPV) for each proposed store.

c. Calculate the internal rate of return (IRR), rounded to the nearest whole percent, for each proposed store.

d. Draw the net present value profiles for each store on the same set of axes, and discuss any conflict in ranking that may exist between NPV and IRR.

e. Evaluate the acceptability of each proposed store dictated by each measure, and indicate which project you would recommend. Explain why.

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart