Eco Media Limited is a medium-sized firm specializing in print and digital marketing. It is privately owned

Question:

Eco Media Limited is a medium-sized firm specializing in print and digital marketing. It is privately owned and has a client base that is spread across Europe. It specializes in high quality advertising and corporate communication brochures with an average print run of more than 50,000 units. However, lately, there has been a number of issues with Eco’s production owing to obsolete and malfunctioning machinery. The management of Eco has been planning to replace its aging machinery with better machinery for some time. It has identified two options that can be used to achieve the required quantity, quality, and features.

It is expected that the new machinery will reduce the printing cost and improve the quality, putting the firm in a more competitive position. The accountant of Eco has collected following key financial information to aid in the decision-making.

The existing machine was purchased three years ago and had a total installation cost of €1,200,000. It is being depreciated under MACRS, using a five-year recovery period. As of now, this print machine has an economic life of five years.

In the current market, this machine can be sold for €400,000 before taxes. However, if it is retained and used for the remaining five years, it can be sold for €150,000 before taxes.

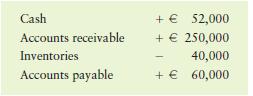

Maxi Print—Option 1—This is a highly automated state of the art machine that has advanced features. This machine can be purchased for €2,200,000 and will require an additional €200,000 for installation. It will be depreciated under MACRS using a five-year recovery period. At the end of five years, the machine can be sold for €1,100,000 before taxes. It is expected that acquiring this machine will cause the following changes in Eco’s working capital

Midi Print—Option 2—This option is less sophisticated than the Maxi Print model. It will cost €1,300,000 and require €80,000 in installation. It will be depreciated under MACRS using a five-year recovery period. At the end of the five years, this machine can be sold for €600,000 net before tax. Acquiring this machine will not have any impact on the working capital situation of the firm.

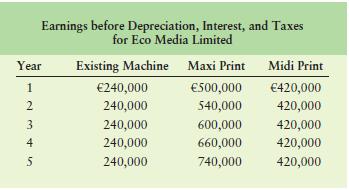

The accounts team have prepared the expected earnings before depreciation, interest, and taxes with the old press, Maxi Print, and Midi Print for each of the five years. These estimates are summarized in the following table. The firm is subject to a 30% tax rate, the cost of capital, r, applicable for the proposed replacement is 12%.

TO DO

a. For each of the two proposed replacement presses, determine:

(1) Initial investment.

(2) Operating cash inflows (include depreciation in year 6).

(3) Terminal cash inflows (at the end of year 5).

b. Using the data developed in part

a, create a timeline depicting the relevant cash flow streams associated with each of the two proposed options. Assume that both machines will be terminated at the end of year 5.

c. Using the cash flow identified in part b, calculate the following:

(1) Payback period. (Note: For year 5, use only operating cash flow and exclude terminal cash flow.)

(2) Net present value (NPV).

(3) Internal rate of return (IRR).

d. Draw the new present value profiles for the two replacement options on the same set of axes and discuss the rankings of the two options. Identify any conflict with the conclusions that you may draw using the NPV and the IRR techniques.

e. Based on the analysis done in the previous parts, identify which (if either) of the machines the firm should invest in if the firm has (1) unlimited funds and (2) capital rationing.

Reconsider the fluctuations in the cash flow offered by Maxi Print and Midi Print and identify which of these appear to be more risky using qualitative observation only. Do you think the difference in the risk profiles of these two cash flows will have any impact on the decisions made in part e?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart