Miller Dental, Inc. is considering replacing its existing laser checking system, which was purchased 3 years ago

Question:

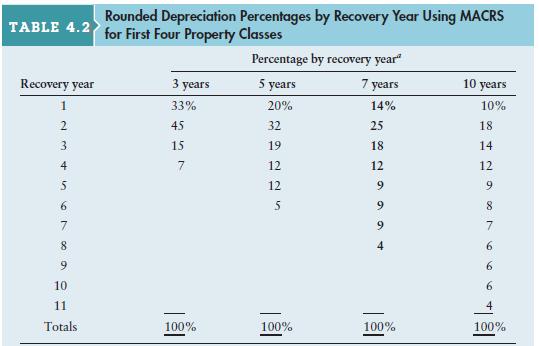

Miller Dental, Inc. is considering replacing its existing laser checking system, which was purchased 3 years ago at a cost of $568,000. The laser checking system can be sold for a lump sum of $253,000. It is being depreciated using MACRS and a 5-year recovery period (see Table 4.2, page 166).

Table 4.2:

A new laser checking system will cost $870,000 to purchase and install. Replacement of the planned laser checking system would not involve any change in net working capital. Assuming a 20% tax rate, calculate the following:

a. The book value of the existing laser checking system.

b. The after-tax proceeds of its sale for $253,000.

c. The initial investment associated with the replacement project.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter