MSF Manufacturing Company is considering the purchase of a new machine to improve its production efficiency. The

Question:

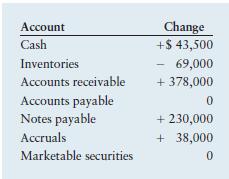

MSF Manufacturing Company is considering the purchase of a new machine to improve its production efficiency. The company has total current assets amounting to $865,000 and total current liabilities of $673,000. As a result of the proposed replacement, the following changes are expected in the amount of the current assets and current liabilities noted.

a. Using the information given, calculate any change in net working capital that is expected to result from the suggested replacement plan.

b. Explain why a change in these current accounts would be relevant in determining the initial investment for the proposed capital expenditure.

c. Would the change in net working capital enter into any of the other cash flow components that make up the relevant cash flows? Explain.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter