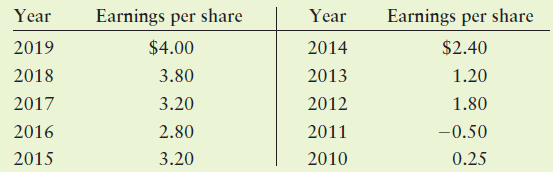

Over the past 10 years, a firm has had the earnings per share shown in the following

Question:

Over the past 10 years, a firm has had the earnings per share shown in the following table.

a. If the firm’s dividend policy were based on a constant payout ratio of 40% for all years with positive earnings and 0% otherwise, what would be the annual dividend for each year?

b. If the firm had a dividend payout of $1.00 per share, increasing by $0.10 per share whenever the dividend payout fell below 50% for 2 consecutive years, what annual dividend would the firm pay each year?

c. If the firm’s policy were to pay $0.50 per share each period except when earnings per share exceed $3.00, when an extra dividend equal to 80% of earnings beyond $3.00 would be paid, what annual dividend would the firm pay each year?

d. Discuss the pros and cons of each dividend policy described in parts a through c.

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart