Bennett Farm Equipment Sales Inc. is in a highly cyclical business. Although the firm has a target

Question:

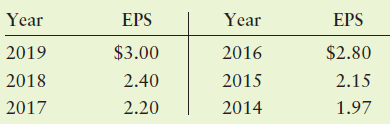

Bennett Farm Equipment Sales Inc. is in a highly cyclical business. Although the firm has a target payout ratio of 25%, its board realizes that strict adherence to that ratio would result in a fluctuating dividend and create uncertainty for the firm’s stockholders. Therefore, the firm has declared a regular dividend of $0.50 per share per year with extra cash dividends to be paid when earnings justify them. Earnings per share for the past several years are shown in the following table.

a. Calculate the payout ratio for each year on the basis of the regular $0.50 dividend and the cited EPS.

b. Calculate the difference between the regular $0.50 dividend and a 25% payout for each year.

c. Bennett has established a policy of paying an extra dividend of $0.25 only when the difference between the regular dividend and a 25% payout amounts to $1.00 or more. Show the regular and extra dividends in those years when an extra dividend would be paid. What would be done with the “extra” earnings that are not paid out?

d. The firm expects that future earnings per share will continue to cycle but will remain above $2.20 per share in most years. What factors should be considered in making a revision to the amount paid as a regular dividend? If the firm revises the regular dividend, what new amount should it pay?

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart