Risk-adjusted discount rates Facebook has come under intense pressure in recent years from privacy advocates and, in

Question:

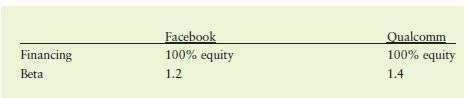

Risk-adjusted discount rates Facebook has come under intense pressure in recent years from privacy advocates and, in the United States, from people concerned about the accuracy of political content posted to the social networking platform. Suppose that Mark Zuckerberg decides that Facebook should diversify its business, moving into the semiconductor arena by acquiring Qualcomm. Analysts at Facebook are charged with building an NPV model to estimate the value to Facebook of buying Qualcomm. Given the information below, what discount rate should Facebook analysts use in their model?

Assume that the risk-free rate is 2% and the expected return on the market is 10%.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart