Roots to Branches Corp., a company specializing in event dcor, is considering two mutually exclusive investments. The

Question:

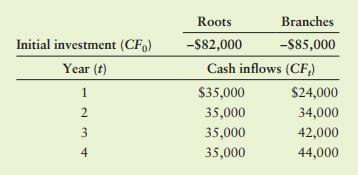

Roots to Branches Corp., a company specializing in event décor, is considering two mutually exclusive investments. The company wishes to use a CAPM-type risk-adjusted discount rate (RADR) in its analysis. Management expects that the appropriate market rate of return is 10%, while they observe that the current risk-free rate of return is 6.5%. The following table shows cash flows associated with the two investment projects.

a. Use a risk-adjusted discount rate approach to calculate the net present value of each project, given that the RADR factor for project Roots is 1.40 and for project Branches is 1.60. The RADR factors are similar to project betas. (Refer to Equation 12.5 to calculate the required project return for each.)

b. Discuss your findings in part a, and recommend the preferred project.

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart