Stephen So, the financial manager for Cathay Pacific In corporation, wishes to evaluate three prospective investments: A,

Question:

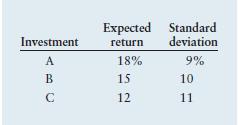

Stephen So, the financial manager for Cathay Pacific In corporation, wishes to evaluate three prospective investments: A, B, and C. Stephen will evaluate each of these investments to decide whether they are superior to investments that his company already has in place, which have an expected return of 15% and a standard deviation of 8%. The expected returns and standard deviations of the investments are as follows:

a. If Stephen were risk neutral, which investments would he select? Explain why.

b. If he were risk averse, which investments would he select? Why?

c. If he were risk seeking, which investments would he select? Why?

d. Given the traditional risk preference behavior exhibited by financial managers, which investment would be preferred? Why?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter