Tasty Bakery Corporation is evaluating the acquisition of a bakery machine that costs $72,000 and requires $3,000

Question:

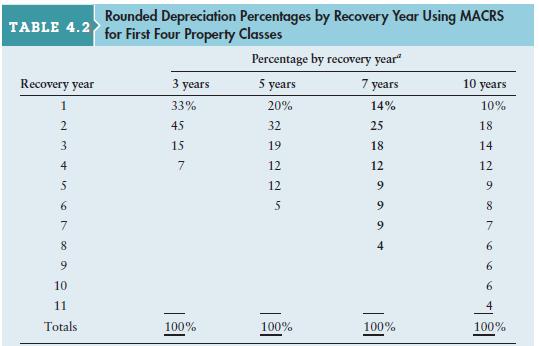

Tasty Bakery Corporation is evaluating the acquisition of a bakery machine that costs $72,000 and requires $3,000 in installation costs. If the corporation depreciates the machine under MACRS, using a 5-year recovery period (see Table 4.2 on page 166 for the applicable depreciation percentages), determine the depreciation charge for each year.

Table 4.2:

Transcribed Image Text:

TABLE 4.2 Recovery year 1 2 3 4 56700 8 9 10 11 Totals Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes 3 years 33% 45 15 7 100% Percentage by recovery year" 5 years 7 years 20% 14% 25 18 12 32 19 225 12 12 100% 9 9 9 100% 10 years 10% 18. 14 12 9 8 7 6 6 6 100%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

To calculate the depreciation charge for each year using MACRS with a 5year recovery period you can ...View the full answer

Answered By

Abdul Wahab Qaiser

Before working at Mariakani, I volunteered at a local community center, where I tutored students from diverse backgrounds. I helped them improve their academic performance and develop self-esteem and confidence. I used creative teaching methods, such as role-playing and group discussions, to make the learning experience more engaging and enjoyable.

In addition, I have conducted workshops and training sessions for educators and mental health professionals on various topics related to counseling and psychology. I have presented research papers at conferences and published articles in academic journals.

Overall, I am passionate about sharing my knowledge and helping others achieve their goals. I believe that tutoring is an excellent way to make a positive impact on people's lives, and I am committed to providing high-quality, personalized instruction to my students.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted:

Students also viewed these Business questions

-

A firm is evaluating the acquisition of an asset that costs $64,000 and requires $4,000 in installation costs. If the firm depreciates the asset under MACRS, using a 5-year recovery period, determine...

-

Consider this 5 number summary for a 22point quiz given to a class. 5, 12, 14, 17, 21 What percentage of students earned 17points or more on the quiz? Answer: Pregnancies from contraception to birth...

-

Holmes Corporation is a leading designer and manufacturer of material handling and processing equipment for heavy industry in the United States and abroad. Its sales have more than doubled, and its...

-

Suppose you want to buy a house that is sold by way of a first-price sealed bid auction. In contrast to the model in the lecture, there are more than 2 players. Players simultaneously and...

-

Benjamin Moses, chief engineer of Offshore Chemicals, Inc., must decide whether to build a new processing facility based on an experimental technology. If the new facility works, the company will...

-

The data file Quarterly Sales shows quarterly sales of a corporation over a period of 6 years. Use the Holt-Winters seasonal method to obtain forecasts of sales up to eight quarters ahead. Employ...

-

Consider a correctly specified regression model with $p$ terms, including the intercept. Make the usual assumptions about $\varepsilon$. Prove that \[\sum_{i=1}^{n}...

-

Jane Myers is the manager of an extremely successful gift shop, Janes Gifts, which is operated for the benefit of local charities. From the data below, she wants a cash budget showing expected cash...

-

Discounted economy airfares have risen the most, but there is still strong demand for them. What does this suggest about the price elasticity of demand (PED) for these fares, the slope of the demand...

-

1. The image of David Lucas that emerges from majority Justice Scalias description is strikingly different from the one that Justice Blackmun creates in his dissent. What are the two contrasting...

-

Sony Pacific Music Corporation is considering the purchase of a new sound board used in recording studios to improve its sound effect. The existing sound board was purchased 3 years ago at an...

-

Stable Nuclear Plant Corporation has estimated the cash flows over the 5-year lives for two projects, A and B. These cash flows are summarized in the table below. a. If project A were actually a...

-

Why dont coal, oil, and natural gas fit the accepted definition of a mineral? (See Problem 2.21)

-

The molarity of a solute in solution is defined to be the number of moles of solute per liter of solution \(\left(1ight.\) mole \(=6.02 \times 10^{23}\) molecules \()\). If \(X\) is the molarity of a...

-

What are the most significant aspects of the ACA? Which of these have been implemented? Which have not been, and why not?

-

What indications would suggest that a state machine has not been drawn to model state changes?

-

What are the advantages of separating the analysis and design phases of a project?

-

In what ways is your companys environmental sustainability strategy in the best long-term interest of shareholders? Does it contribute to your companys competitive advantage or profitability?

-

Describe the major fixed-costs and variable costs associated with each of the following: a. grass cutting b. making pizza c. bus transportation d. babysitting e. making automobiles f. heart...

-

What is your opinion of advertising awards, such as the Cannes Lions, that are based solely on creativity? If you were a marketer looking for an agency, would you take these creative awards into...

-

How are total risk, nondiversifiable risk, and diversifiable risk related? Why is nondiversifiable risk the only relevant risk?

-

What risk does beta measure? How can you find the beta of a portfolio?

-

Explain the meaning of each variable in the capital asset pricing model (CAPM) equation. What is the security market line (SML)?

-

5. [3 Marks] Convert the following decimal numbers to binary using the two's complement format, using 16 bits: a. 3276010 b. -3276010 6. [2 Marks] Briefly explain why two's complement is the best...

-

What is the purpose of Fire Prevention Activities? Methods of Fire prevention and their activities start before the building is even built. Summarize what is the purpose of Hazard Evaluation and...

-

a) Compute by hand the Lagrangian cardinal functions for the points x0 = -1, x = 0, x2 = 1, x3 = 2. b) Consider the function f(x) = 2x-4-x and interpolate it by a polynomial of minimal degree by hand...

Study smarter with the SolutionInn App