Question: The income statement and balance sheet are the basic reports that a firm constructs for use by management and for distribution to stockholders, regulatory bodies,

The income statement and balance sheet are the basic reports that a firm constructs for use by management and for distribution to stockholders, regulatory bodies, and the general public. They are the primary sources of historical financial information about the firm. Dayton Products, Inc., is a moderate-sized manufacturer. The company’s management has asked you to perform a detailed financial statement analysis of the firm.

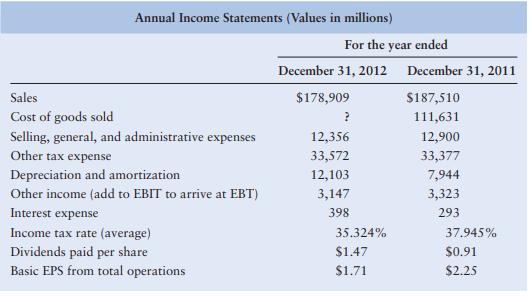

The income statements for the years ending December 31, 2012 and 2011, respectively, are presented in the table below. (Note: Purchases of inventory during 2012 amounted to $109,865.)

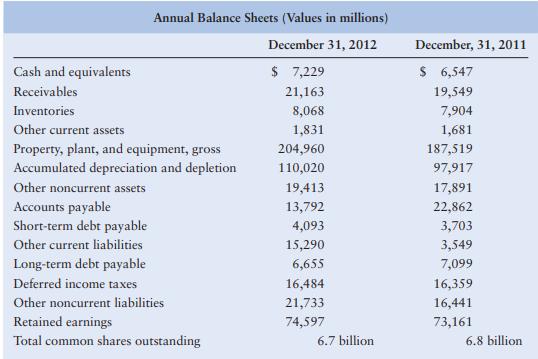

You also have the following balance sheet information as of December 31, 2012 and 2011, respectively.

TO DO

a. Create a spreadsheet similar to Table 3.1 to model the following:

(1) A multiple-step comparative income statement for Dayton, Inc., for the periods ending December 31, 2012 and 2011. You must calculate the cost of goods sold for the year 2012.

(2) A common-size income statement for Dayton, Inc., covering the years 2012 and 2011.

b. Create a spreadsheet similar to Table 3.2 to model the following:

(1) A detailed, comparative balance sheet for Dayton, Inc., for the years ended December 31, 2012 and 2011.

(2) A common-size balance sheet for Dayton, Inc., covering the years 2012 and 2011.

c. Create a spreadsheet similar to Table 3.8 to perform the following analysis:

(1) Create a table that reflects both 2012 and 2011 operating ratios for Dayton, Inc., segmented into (a) liquidity, (b) activity, (c) debt, (d) profitability, and (e) market. Assume that the current market price for the stock is $90.

(2) Compare the 2012 ratios to the 2011 ratios. Indicate whether the results “outperformed the prior year” or “underperformed relative to the prior year.”

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

The income statement and balance sheet are the primary reports that a firm constructs for use by management and for distribution to stockholders regulatory bodies and the general public They are the p... View full answer

Get step-by-step solutions from verified subject matter experts