Caseys Kitchens makes two types of food smokers: Gas and Electric. The company expects to manufacture 20,000

Question:

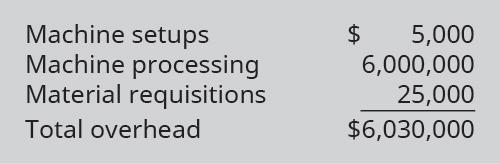

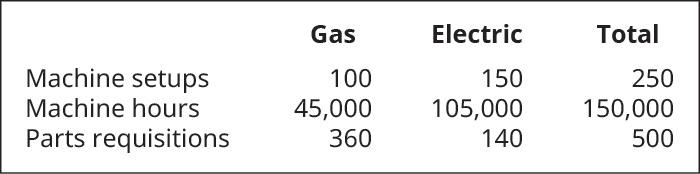

Casey’s Kitchens makes two types of food smokers: Gas and Electric. The company expects to manufacture 20,000 units of Gas smokers, which have a per-unit direct material cost of $15 and a per-unit direct labor cost of $25. It also expects to manufacture 50,000 units of Electric smokers, which have a per-unit material cost of $20 and a per-unit direct labor cost of $45. Historically, it has used the traditional allocation method and applied overhead at a rate of $125 per machine hour. It was determined that there were three cost pools, and the overhead for each cost pool is as follows:

The cost driver for each cost pool and its expected activity is as follows:

A. What is the per-unit cost for each product under the traditional allocation method?

B. What is the per-unit cost for each product under ABC costing?

C. Compared to ABC costing, was each product’s overhead under- or overapplied?

D. How much was overhead under- or overapplied for each product?

Step by Step Answer:

Principles Of Accounting Volume 2 Managerial Accounting

ISBN: 9780357364802

1st Edition

Authors: OpenStax