Mason, Inc., is considering the purchase of a patent that has a cost of $85,000 and an

Question:

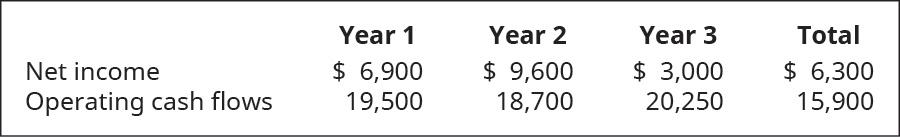

Mason, Inc., is considering the purchase of a patent that has a cost of $85,000 and an estimated revenue producing life of 4 years. Mason has a required rate of return that is 12% and a cost of capital of 11%. The patent is expected to generate the following amounts of annual income and cash flows:

A. What is the NPV of the investment?

B. What happens if the required rate of return increases?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Accounting Volume 2 Managerial Accounting

ISBN: 9780357364802

1st Edition

Authors: OpenStax

Question Posted: