Falkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an

Question:

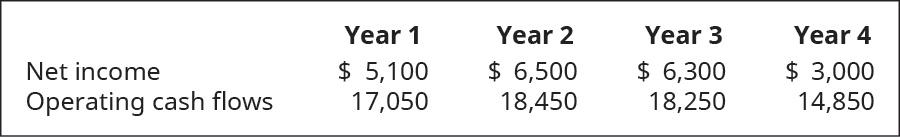

Falkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows:

A. What is the NPV of the investment?

B. What happens if the required rate of return increases?

Transcribed Image Text:

Net income Operating cash flows Year 1 $ 5,100 17,050 Year 2 $ 6,500 18,450 Year 3 $ 6,300 18,250 Year 4 $ 3,000 14,850

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

To calculate the Net Present Value NPV of the investment we need to discount all the future cash flo...View the full answer

Answered By

Abdul Wahab Qaiser

Before working at Mariakani, I volunteered at a local community center, where I tutored students from diverse backgrounds. I helped them improve their academic performance and develop self-esteem and confidence. I used creative teaching methods, such as role-playing and group discussions, to make the learning experience more engaging and enjoyable.

In addition, I have conducted workshops and training sessions for educators and mental health professionals on various topics related to counseling and psychology. I have presented research papers at conferences and published articles in academic journals.

Overall, I am passionate about sharing my knowledge and helping others achieve their goals. I believe that tutoring is an excellent way to make a positive impact on people's lives, and I am committed to providing high-quality, personalized instruction to my students.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 2 Managerial Accounting

ISBN: 9780357364802

1st Edition

Authors: OpenStax

Question Posted:

Students also viewed these Business questions

-

Mason, Inc., is considering the purchase of a patent that has a cost of $85,000 and an estimated revenue producing life of 4 years. Mason has a required rate of return that is 12% and a cost of...

-

1. ABC, Inc is planning the purchase of new equipment that costs $102336. The project is expected to last for 5 years. Each year, the new project is expected to sell 108 units for $463 per unit. The...

-

Study the information given below and answer the following questions: (25 Marks) 1.1 Calculate the Payback Period of both machines (answers expressed in years, months and days). (5 marks) 1.2 Which...

-

If you can't find similar ratios to class-covered ones, use financial formulas to calculate them manually. Choose up to two of the following: Operating Margin EBITDA Margin Payout Ratio 3. Analysis...

-

From the adjustments section of a worksheet presented in Figure, prepare adjusting journal entries for the end ofJanuary. Adjustments Dr Cr repaid Rent Office Supplies Accumulated Depreciation,...

-

Specialty Polymers, Inc., processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 19,000 units...

-

What does argv provide to our program?

-

Classification of Acquisition and Other Asset Costs At December 31, 2009, certain accounts included in the property, plant, and equipment section of Reagan Companys balance sheet had the following...

-

Find a HAMILTONIAN PATH of the graph below (Give a sequence of letters to describe the path (e.g. A, D, E, B, A etc.) B E F G Paragraph B I UA Lato (Recom... v 19px... v L > Ea 5 0

-

The third step for making a capital investment decision is to establish baseline criteria for alternatives. Which of the following would not be an acceptable baseline criterion? A. Payback method B....

-

Assume a company is going to make an investment in a machine of $825,000 and the following are the cash flows that two different products would bring. Which of the two options would you choose based...

-

Calculate the processing load and available capacity and develop the load profile for the dishwasher. Eight employees work the assembly process for 40 per week each. As the planner, what concerns do...

-

Typically, cultural factors drive the differences in business etiquette encountered during international business travel. In fact, Middle Eastern cultures exhibit significant differences in business...

-

You are preparing for a business trip to Brazil, where you will need to interact extensively with local professionals. As a result, you want to collect information about the local culture and...

-

Today, a lot of discussion centers on how much economic power, political influence, and international competitiveness the Peoples Republic of China (PRC) has achieved in the international marketplace...

-

Hotel Amazing is attempting to select the best of a group of independent projects competing for the firms fixed capital budget of $5.5 million. Management recognizes that any unused portion of this...

-

A 30 ft by 40 ft classroom with 8 ft high ceilings will have an ambient lighting target illuminance of 70 fc at a work plane that is 28 inches above the floor. It is anticipated that the ceiling...

-

On January 1, 2009, Kundi acquired (cum div.) a 70% interest in Eagle. The following balances appeared in the records of Eagle at this date: Share capital100,000 shares... $100,000 Retained earnings...

-

Write a declaration for each of the following: a. A line that extends from point (60, 100) to point (30, 90) b. A rectangle that is 20 pixels wide, 100 pixels high, and has its upper-left corner at...

-

Identify different types of plans and control systems employed by organizations.

-

You are a sales manager and have reviewed the monthly sales goals and conclude that the targets cant be achieved without additional hires or paying employees overtime to secure additional orders....

-

Outline the planning and controlling processes.

-

What do you think are some of the organizational challenges of supporting this innovation in the organization?

-

explain to me how these are both leasehold improvements with same original lease terms and renewals but have different percent's for cost of improvements. For example one has 15% and the other...

-

Consider the following combinational circuits: (i) F(x,y,z) =(1,2,5,6) F(x,y,z) = (1,3) F,(x,y,z) (0,4,7) (ii) F,(w,x,y,z) =(0,4,6,10,12,14) F(w,x,y,z) (2,3,4,8,11,15) F,(w,x,y,z) (0,2,9,13)...

Study smarter with the SolutionInn App