Tillie Corp. had the following accounts relating to property, plant, and equipment on its 31 December 20X2

Question:

Tillie Corp. had the following accounts relating to property, plant, and equipment on its 31 December 20X2 balance sheet:

Land ................................................... $384,000

Buildings ............................................ 832,000

Equipment ........................................ 1,024,000

Leasehold improvements ............... 512,000

The following information was provided relating to purchases in 20X3:

1. Site 10A was acquired for $1,000,000. The site was immediately put on the market for resale.

2. Site 10B was acquired for $1,920,000. Additionally, to acquire the land, the following costs were incurred or earned:

Real estate fees ......................................................................... $115,000

Land-clearing costs .................................................................... $19,000

Incidental revenues earned (related to land-clearing) ......... $12,400

3. Site 10C, which consists of both land and a building, was purchased for $504,000. The land is valued at $336,000 and the building was valued at $168,000. In order to prepare the land for its intended use, the building was demolished at a total cost of $35,000. The building was completed and occupied on 1 October 20X3. The building was constructed for the following costs:

Construction of building ................................ $320,000

Excavation fees ............................................... $33,800

Architectural design fees ............................... 22,600

Building permit fee ........................................ 6,500

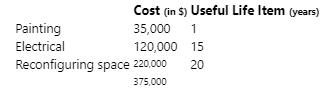

4. Tillie completed some interior improvements to a building under lease. The total cost of the work was as follows:

5. A group of new equipment was purchased. The invoice price of the machines was $125,000, shipping costs were $4,500, and installation costs were $16,700. Regular maintenance on the machines costs $3,000 per month.

6. In December 20X3, $85,000 was spent to redo flooring of a leased office space.

Required:

1. Prepare a detailed analysis of the changes in each of the following balance sheet accounts for 20X3:

1. Land

2. Buildings

3. Equipment

4. Leasehold improvements

Disregard the related accumulated depreciation accounts.

2. Identify the items that would appear on the SCF in relation to the accounts in requirement 1.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260881233

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel