Question: a. Analysis: Identify the relevant assertions for property, plant, and equipment, and indicate the principal substantive tests pertaining to each. b. Evaluate: Indicate whether each

a. Analysis: Identify the relevant assertions for property, plant, and equipment, and indicate the principal substantive tests pertaining to each.

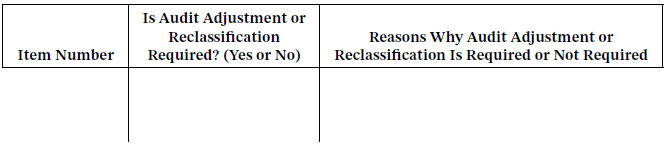

b. Evaluate: Indicate whether each of the items numbered 1 to 4 above requires one or more audit adjustments or reclassifications, and explain why such adjustments or reclassifications are required or not required. Organize your answers as follows:

Goodfellow and Perkins LLP is a successful mid-tier accounting firm with a large range of clients across Texas. During 2022, Goodfellow and Perkins gained a new client, Brookwood Pines Hospital, a private, not-for-profit hospital. The fiscal year-end for Brookwood Pines is June 30. You are performing the audit field work for the 2023 fiscal year-end. The field work must be completed in time for the audit report to be signed on August 21, 2023. The balance sheet for Brookwood Pines includes the caption ?Property, Plant, and Equipment.? Goodfellow and Perkins has been asked by the company?s management if audit adjustments or reclassifications are required for the following material items that have been included in or excluded from property, plant, and equipment:

1. A tract of land was acquired during the year. The land is the future site for expansion of the hospital, which will be constructed in the following year. Commissions were paid to the real estate agent used to acquire the land, and expenditures were made to relocate the previous owner?s equipment. These commissions and expenditures were expensed and are excluded from property, plant, and equipment.

2. Clearing costs were incurred to make the land ready for construction. These costs were included in property, plant, and equipment.

3. During the land-clearing process, timber and gravel were recovered and sold. The proceeds from the sale were recorded as other income and are excluded from property, plant, and equipment.

4. A group of diagnostic machines was purchased under a royalty agreement that provides royalty payments based on how often the machines were used to deliver diagnostics services. The cost of the machines, freight costs, unloading charges, and royalty payments were capitalized and are included in property, plant, and equipment.

Is Audit Adjustment or Reasons Why Audit Adjustment or Reclassification Is Required or Not Required Reclassification Required? (Yes or No) Item Number

Step by Step Solution

3.57 Rating (168 Votes )

There are 3 Steps involved in it

Item No Is Audit Adjustment or Reclassification Required Yes or No Reasons Why Audit Adjustment or R... View full answer

Get step-by-step solutions from verified subject matter experts