Before entering the business world, Patrick Byrne, the son of a wealthy associate of Warren Buffett, lived

Question:

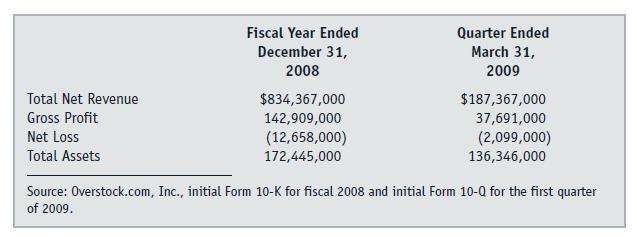

Before entering the business world, Patrick Byrne, the son of a wealthy associate of Warren Buffett, lived the life of a bon vivant and Renaissance man. After spending time as a student in China, Byrne earned an undergraduate degree from Dartmouth, a Master's degree from Cambridge, and a doctorate in philosophy from Stanford. In addition to accumulating an impressive educational portfolio, Bryne traveled the world, earned a black belt in martial arts, made a brief foray into professional boxing, and served as a university instructor.Warren Buffet launched Patrick Byrne's career in the field of corporate management in 1998 when he asked him to serve as the interim CEO of a financially troubled subsidiary of Berkshire Hathaway, Buffett's flagship company. Eighteen months later, Byrne struck out on his own when he acquired a controlling interest in a small online company based in Salt Lake City that marketed "excess" and "closeout" merchandise over the Internet. Byrne was convinced that with the proper business plan, capitalization, and management team in place, the company's core concept could be wildly profitable.Over the following few months, Byrne appointed himself CEO, invested several million dollars to expand the company's operations, and renamed it Overstock.com. In 2000 and 2001, the spectacular bursting of the "dot.com bubble" decimated hundreds of New Age Internet-based companies that had sprung up like wild mushrooms over the prior decade. The resulting carnage caused the NASDAQ Composite Index that is laced with e-commerce companies to decline by approximately 80 percent in less than three years.While most online companies were either being forced to shut down or significantly curtail their operations, Patrick Byrne recognized that the dot.com debacle created an opportunity for his company. Overstock began liquidating the unsold merchandise of failing online businesses at fire-sale prices. In 2002, the company's growing revenues and apparently strong business model caused Business Week to name Byrne one of the 25 most influential corporate executives in the rapidly evolving e-commerce sector of the national economy. That same year, Patrick Byrne took Overstock public, the first online retailer to do so in almost two years. The company raised $40 million with its initial public offering (IPO) and listed its common stock on the NASDAQ stock exchange.Gradually, two distinct lines of business emerged within Overstock's exclusively online operations. Overstock's "Direct" line of business sold merchandise that it had acquired from other sources to individuals and companies. In Overstock's much larger "Partner" line of business, the company served as an intermediary or sales agent for more than 3,000 "business partners."2 Overstock earned a commission on the merchandise sales that it arranged or facilitated for those partners. For accounting and financial reporting purposes, Overstock recorded most sales of partners' merchandise as gross revenue and then subtracted the cash remittances made to those partners as cost of goods sold; the differences between those amounts represented the commissions earned by Overstock on the sales transactions.In 2000 and 2001, the spectacular bursting of the "dot.com bubble" decimated hundreds of New Age Internet-based companies that had sprung up like wild mushrooms over the prior decade. The resulting carnage caused the NASDAQ Composite Index that is laced with e-commerce companies to decline by approximately 80 percent in less than three years.While most online companies were either being forced to shut down or significantly curtail their operations, Patrick Byrne recognized that the dot.com debacle created an opportunity for his company. Overstock began liquidating the unsold merchandise of failing online businesses at fire-sale prices. In 2002, the company's growing revenues and apparently strong business model caused Business Week to name Byrne one of the 25 most influential corporate executives in the rapidly evolving e-commerce sector of the national economy. That same year, Patrick Byrne took Overstock public, the first online retailer to do so in almost two years. The company raised $40 million with its initial public offering (IPO) and listed its common stock on the NASDAQ stock exchange.Gradually, two distinct lines of business emerged within Overstock's exclusively online operations. Overstock's "Direct" line of business sold merchandise that it had acquired from other sources to individuals and companies. In Overstock's much larger "Partner" line of business, the company served as an intermediary or sales agent for more than 3,000 "business partners."2 Overstock earned a commission on the merchandise sales that it arranged or facilitated for those partners. For accounting and financial reporting purposes, Overstock recorded most sales of partners' merchandise as gross revenue and then subtracted the cash remittances made to those partners as cost of goods sold; the differences between those amounts represented the commissions earned by Overstock on the sales transactions.

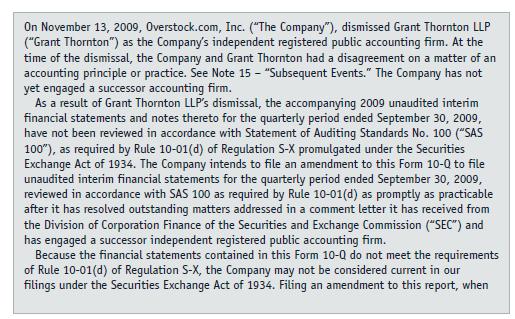

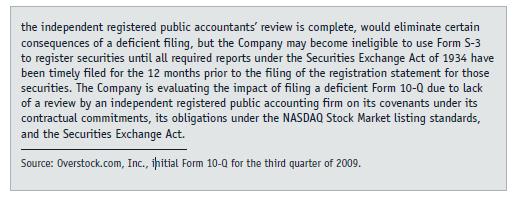

Questions1. The Overstock-Grant Thornton dispute was publicly aired via disclosure statements filed with the SEC. What impact do you believe those disclosures had on the investing public’s confidence in the financial reporting domain and the independent audit function? Were the interactions between Overstock and Grant Thornton unprofessional or otherwise inappropriate? Explain.2. Do you believe that the $785,000 amount at the center of the Overstock-Grant Thornton dispute was material? Defend your answer. What factors other than quantitative considerations should have been considered in deciding whether the $785,000 amount was material?

3. Briefly compare and contrast the nature and purpose of an independent audit versus a quarterly review.4. The SEC requires registrants to have their quarterly financial statements reviewed by an independent accounting firm but does not mandate that a review report be included in a Form 10-Q. Under what circumstances must a review report accompany quarterly financial statements in a 10-Q? Why doesn’t the SEC routinely require public companies to include their review reports in their 10-Q filings?5. What is the purpose or purposes of Form 8-K filings by SEC registrants? What specific items of information must be included in an 8-K that announces a change in audit firms?6. Do you agree with the accounting treatment that Overstock typically applied to the revenues generated by its “Partner” line of business? Why or why not?

Step by Step Answer: