Gather information: Considering both industry and entity factors, what are the major inherent risks in the MSI

Question:

Gather information: Considering both industry and entity factors, what are the major inherent risks in the MSI audit?

Mobile Security, Inc. (MSI) has been an audit client of Leo & Lee LLP for the past 12 years. MSI is a small, publicly traded aviation company based in Cleveland, Ohio, where it manufactures high-tech unmanned aerial vehicles (UAV), also known as drones, and other surveillance and security equipment. MSI?s products are primarily used by the military and scientific research institutions, but there is growing demand for UAVs for commercial and recreational use. MSI must go through an extensive bidding process for large government contracts. Because of the sensitive nature of government contracts and military product designs, both the facilities and records of MSI must be highly secured.

In October 2022, MSI installed a new cloud-based inventory costing system to replace a system that had been developed in-house. The old system could no longer keep up with the complex and detailed manufacturing costing process that provides information to support competitive bidding.

MSI?s IT department, together with the consultants from the software company, implemented the new inventory costing system which went live on December 1, 2022. Key operational staff and the internal audit team from MSI were significantly engaged in the selection, testing, training, and implementation stages.

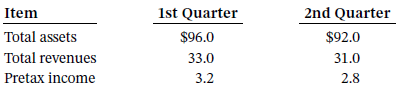

MSI?s fiscal year-end is June 30. The following table shows financial information for the first two quarters of the fiscal year-end June 30, 2023 (amounts in millions). Note that the financial data listed are for the three-month quarter ended (i.e., the second quarter does not include the first quarter data).

The pretax income for the first two quarters is reasonable with a net profit margin falling between 8?10% of sales. Based on prior years, pretax income for the third quarter usually holds steady relative to the second quarter, but pretax income for the fourth quarter typically decreases by 20% over the third quarter as governments reach the end of their spending budgets.

Step by Step Answer:

Auditing A Practical Approach with Data Analytics

ISBN: 978-1119401742

1st edition

Authors: Raymond N. Johnson, Laura Davis Wiley, Robyn Moroney, Fiona Campbell, Jane Hamilton