The surging demand for petroleum products in recent decades has produced a windfall of revenues for many

Question:

The surging demand for petroleum products in recent decades has produced a windfall of revenues for many oil-rich Islamic countries in the Middle East, including, among others, Kuwait, Saudi Arabia, and the United Arab Emirates. Because Islam limits the types of investments and business ventures in which the world's 1.8 billion Muslims can become involved, the Middle Eastern oil boom has resulted in the emergence of an Islamic economy that is largely distinct from the rest of the global economy.1 In recognition of this new economy, which is the world's most rapidly growing economic sector, major business publications have established market indices devoted strictly to Islamic business enterprises. These indices include the Dow Jones Islamic Market World Index and the FTSE Shariah Global Equity Index.

Banking ranks among the fastest-growing and most important components of the burgeoning Islamic economy. In the early 1970s, only a few small Middle Eastern banks expressly embraced the restrictive conditions imposed on business transactions and relationships by the Islamic religion and thus qualified as "Islamic" banks.

Collectively, the assets of those banks totaled less than $20 million. Hundreds of banks around the globe now cater exclusively or primarily to devout Muslims.

Those Islamic banks boast total assets of more than two trillion dollars. The principal Islamic banking centers are Malaysia, the Middle East, and the United Kingdom, but financial institutions throughout the world have developed aggressive marketing campaigns to attract Muslim clients. By 2020, approximately twenty banks in the United States offered financial services designed exclusively for the estimated six million Muslim-Americans.

Tenets of the Islamic religion dramatically influence the nature of banking practices within the Islamic economy. Easily the biggest difference between Islamic banking and Western banking is the prohibition against interest payments on capital within the Islamic world.

Islamic religious law or Shari'a2 forbids the payment or receipt of riba (interest) in personal or business relationships. Islamic banks have been forced to develop unique and elaborate profit and risk-sharing contracts known as mudarabah to allow them to provide financial services without paying interest on their depositors' funds or charging interest to their "borrowers." As noted in a special report on Islamic finance published by the London-based Financial Times, "Islamic finance tries to replicate the conventional [banking] market, but in a structure that uses profits rather than interest."3

Questions

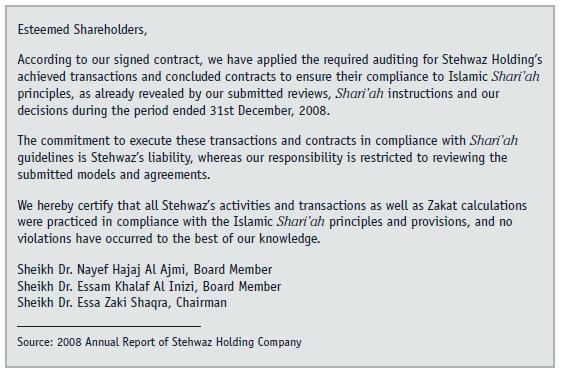

1. Identify specific financial statement auditing concepts and procedures that could be applied in determining whether an Islamic bank has been Shari'a compliant during a given financial reporting period. Would these concepts and procedures be applied differently in Shari'a compliance audits compared to conventional financial statement audits?

2. Do you believe that the proposal to merge Shari'a compliance audits with financial statement audits is feasible? Defend your answer.

3. Do you agree with the assertion that "accounting can lead to perceptions of reality"? Why or why not? In deciding whether to adopt a proposed accounting standard, should accounting rule-making bodies consider whether that standard might induce socially irresponsible behavior on the part of economic decisionmakers? Defend your answer.

4. Identify the key challenges that the Big Four firms will likely face in their efforts to establish a major presence in the Islamic banking industry.

Step by Step Answer: