We had a fairly good year, said the president of Fannin Ltd. Sales exceeded $2,000,000 for the

Question:

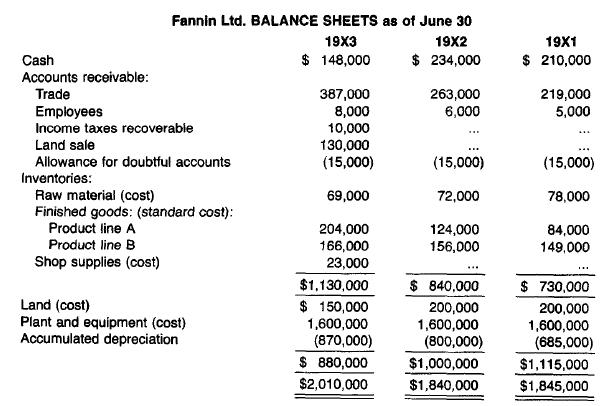

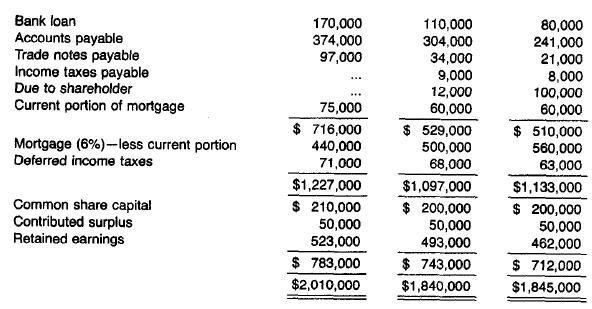

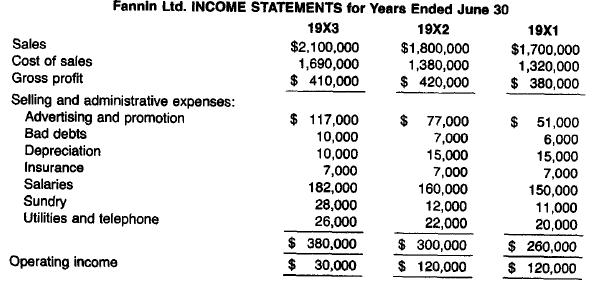

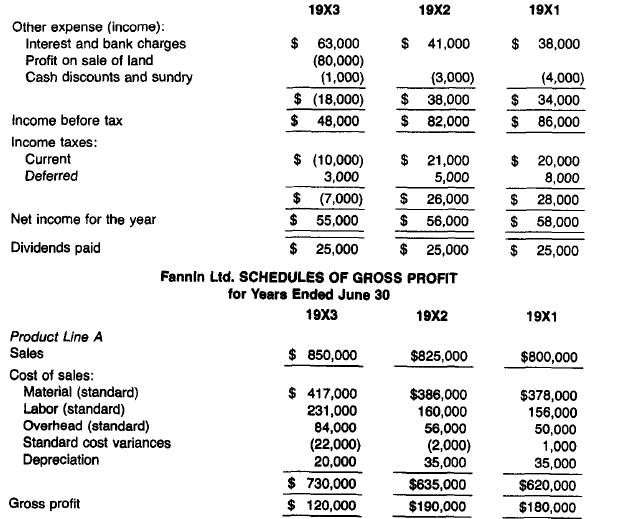

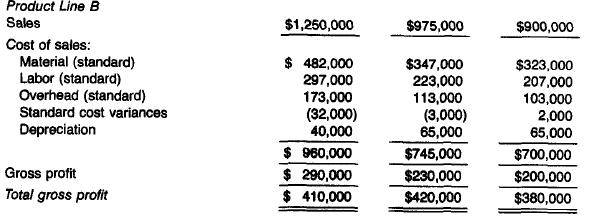

"We had a fairly good year," said the president of Fannin Ltd. "Sales exceeded $2,000,000 for the first time in our history, though net income didn't keep pace with the sales increase because of higher labor costs." Fannin Ltd., is a Canadian manufacturing company; its factory and most of its sales branches are located in western Canada, but it also has sales branches and warehouse facilities in Toronto, Montreal, and Halifax. The company sells a number of industrial products, divided into "Product Line A" and "Product Line B." The industry is highly competitive, in both price and quality, and technological developments have been quite rapid, subjecting most products to a substantial obsolescence risk. The company's accounting functions are concentrated at the factory; the sales branches and warehouses maintain only payroll, petty cash, and inventory records, which are subject to review by the head office. The company's four principal officers (the president, the sales manager, the product development manager, and the factory manager) own substantially all its shares and manage the company in a highly individualistic manner. Assume that you are the partner in charge of the Fannin Ltd. audit. Following are the financial statements for the fiscal years ended June 30, 19X3, 19X2, and 19X1. (The 19X2 and 19X1 figures were those reported in the audited financial statements, but the 19X3 figures were as prepared by the chief accountant prior to the audit.)

In planning the audit of Fannin Ltd. for the year ended June 30, 19X3, which specific matters shown by the financial statements would the auditor be particularly interested in investigating? Explain the significance of each item you mention. In making this analysis, specify the amount you would consider material to the financial statements being audited and the factors that would affect your assessment of audit risk and make use of this information and analytical procedures.

Step by Step Answer:

Auditing Concepts And Methods A Guide To Current Auditing Theory And Practice

ISBN: 9780070099999

5th Edition

Authors: Mcgraw-Hill