There is a great deal of disagreement concerning the shape of the AS curve. One view of

Question:

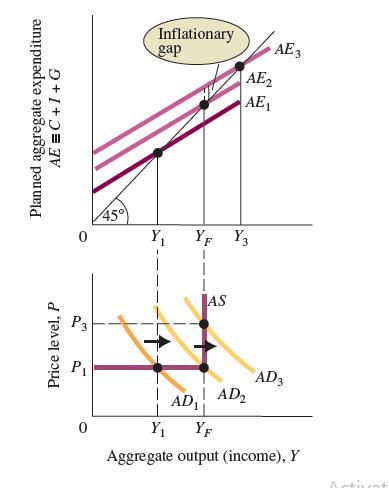

There is a great deal of disagreement concerning the shape of the AS curve. One view of the aggregate supply curve, the simple “Keynesian” view, holds that at any given moment, the economy has a clearly defined capacity, or maximum, output. This maximum output, denoted by YF, is defined by the existing labor force, the current capital stock, and the existing state of technology. If planned aggregate expenditure increases when the economy is producing below this maximum capacity, this view holds, inventories will be lower than planned, and firms will increase output, but the price level will not change. Firms are operating with underutilized plants (excess capacity), and there is cyclical unemployment.

Expansion does not exert any upward pressure on prices. However, if planned aggregate expenditure increases when the economy is producing near or at its maximum (YF), inventories will be lower than planned, but firms cannot increase their output. The result will be an increase in the price level, or inflation.

This view is illustrated in the figure. In the top half of the diagram, aggregate output (income) (Y) and planned aggregate expenditure (C + I + G ≡ AE) are initially in equilibrium at AE1, Y1, and price level P1. Now suppose an increase in government spending increases planned aggregate expenditure. If such an increase shifts the AE curve from AE1 to AE2 and the corresponding aggregate demand curve from AD1 to AD2, the equilibrium level of output will rise from Y1 to YF. (Remember, an expansionary policy shifts the AD curve to the right.) Because we were initially producing below capacity output (Y1 is lower than YF), the price level will be unaffected, remaining at P1.

Now consider what would happen if AE increased even further. Suppose planned aggregate expenditure shifted from AE2 to AE3, with a corresponding shift of AD2 to AD3. If the economy were producing below capacity output, the equilibrium level of output would rise to Y3. However, the output of the economy cannot exceed the maximum output of YF.

As inventories fall below what was planned, firms encounter a fully employed labor market and fully utilized plants. Therefore, they cannot increase their output. The result is that the aggregate supply curve becomes vertical at YF, and the price level is driven up to P3.

The difference between planned aggregate expenditure and aggregate output at full capacity is sometimes referred to With planned aggregate expenditure of AE1 and aggregate demand of AD1, equilibrium output is Y1. A shift of planned aggregate expenditure to AE2, corresponding to a shift of the AD curve to AD2, causes output to rise but the price level to remain at P1. If planned aggregate expenditure and aggregate demand exceed YF, however, there is an inflationary gap and the price level rises to P3.

As an inflationary gap. You can see the inflationary gap in the top half of the figure. At YF (capacity output), planned aggregate expenditure (shown by AE3) is greater than YF. The price level rises to P3 until the aggregate quantity supplied and the aggregate quantity demanded are equal.

Despite the fact that the kinked aggregate supply curve provides some insights, most economists find it unrealistic. It does not seem likely that the whole economy suddenly runs into a capacity “wall” at a specific level of output. As output expands, some firms and industries will hit capacity before others.

Questions

Why is the distance between AE3 and AE2 called an inflationary gap?

Step by Step Answer:

Principles Of Macroeconomics

ISBN: 9781292303826

13th Global Edition

Authors: Karl E. Case,Ray C. Fair , Sharon E. Oster