A popular way to measure the volatility of a financial asset, such as a stock, is its

Question:

A popular way to measure the volatility of a financial asset, such as a stock, is its beta value. If Y = daily return of an asset, and X = daily return of the S&P 500 index fund (the market), then we may write Y = α + βX + ε.

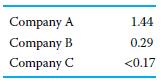

An asset with β = 1 has the same expected return as the market; with β = 1.5, the expected return is 50% higher than the market; with β = 0.75, the expected return is 25%smaller than the market; with β = 0, the asset is uncorrelated to the market; and with β < 0, the asset moves in the opposite direction as the market. The following table provides beta values for some company stocks.

a) Interpret the beta value of company A.

b) Interpret the beta value of company B.

c) Interpret the beta value of company C.

d) If an investor wanted to include in their portfolio an asset that hedges against downturns in the market, which of the stocks presented should they use?

Step by Step Answer:

Principles Of Managerial Statistics And Data Science

ISBN: 9781119486411

1st Edition

Authors: Roberto Rivera