Zeno, Inc. sold two capital assets in 2022. The first sale resulted in a $53,000 capital loss,

Question:

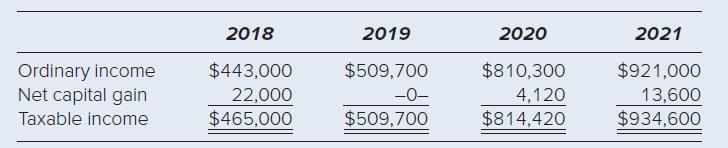

Zeno, Inc. sold two capital assets in 2022. The first sale resulted in a $53,000 capital loss, and the second sale resulted in a $25,600 capital gain. Zeno was incorporated in 2018, and its tax records provide the following information:

a. Compute Zeno’s tax refund from the carryback of its 2022 nondeductible capital loss. Zeno’s marginal tax rate was 21 percent for each prior year.

b. Compute Zeno’s capital loss carryforward into 2023.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Taxation For Business And Investment Planning 2023

ISBN: 9781264229741

26th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick

Question Posted: