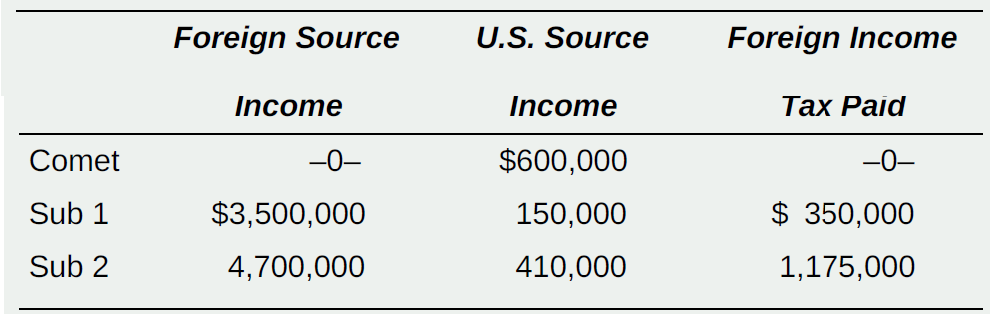

Comet operates solely within the United States. It owns two subsidiaries conducting business in the United States

Question:

a. If Comet and its two subsidiaries file a consolidated U.S. tax return, compute consolidated income tax.

b. How would the aggregate tax of the group change if the three corporations file separate U.S. tax returns?

c. Identify the reason for the difference in the tax liability in parts a and b.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Taxation For Business And Investment Planning 2019 Edition

ISBN: 9781260161472

22nd Edition

Authors: Sally Jones, Shelley C. Rhoades Catanach, Sandra R Callaghan

Question Posted: