(a) Does your state have an individual income tax? If so, how closely does it conform to...

Question:

(a) Does your state have an individual income tax? If so, how closely does it conform to the federal tax? Can one deduct the federal tax in computing the state income tax? List some specific ways that the federal and state tax bases differ. What problems, if any, do these differences create in computing your taxes?

(b) What is the rate structure of your state income tax? Are the rates progressive, and if so, how does that progressivity compare to the federal income tax rate structure?

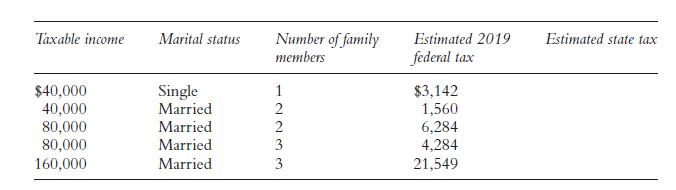

(c) Use the information from parts a and b to estimate state income tax in your state for the families shown in the following table (assuming that all income is taxable and each takes the standard deduction if available):

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: