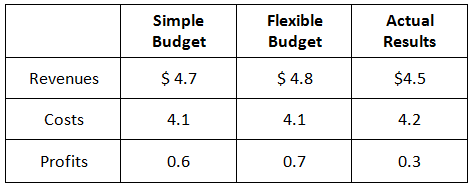

Question: 1. Consider the following 2012 data for Newark General Hospital (in millions of dollars): Simple Flexible Actual Budget Budget Results a. Calculate and interpret the

1. Consider the following 2012 data for Newark General Hospital (in millions of dollars): Simple Flexible Actual Budget Budget Results

a. Calculate and interpret the two profit variances. b. Calculate and interpret the two revenue variances. c. Calculate and interpret the two cost variances. d. How are the variances related?

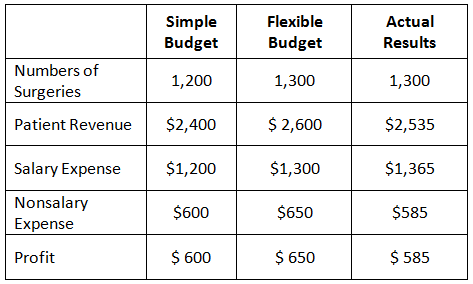

2. Following are the budgets of Brandon Surgery Center for the most recent historical quarter (in thousands of dollars):

The center assumes that all revenues and costs are variable and hence tied directly to patient volume.

The center assumes that all revenues and costs are variable and hence tied directly to patient volume.

a. Explain how each amount in the flexible budget was calculated. (Hint: Examine the simple budget to determine the relationship of each budget line to volume.) b. Determine the variances for each line of the P&L statement, both in dollar terms and in percentage terms. c. What do the results in Part b tell Brandon's managers about the centers c What for the quarter?

3. Fargo Memorial Hospital has annual patient service revenues of $14,400,000. It has two major third-party payers, and some of its patients are self-payers. The hospital's patient accounts manager estimates that io percent of the hospital's billings are paid (received by the hospital) on day 30, 6o percent are paid on Day 6o, and 30 percent are paid on Day 9o. (Five percent of total billings end up as bad debt losses, but that figure is not relevant to this problem.)

a. What is Fargo's average collection period? (Assume 36o days per year throughout this problem.) b. What is the hospital's current receivables balance? c. What would be the hospital's new receivables balance if a newly proposed electronic claims system resulted in collecting from third-party payers in 45 and 75 days, instead of in 6o and 90 days? d. Suppose the hospital's annual cost of carrying receivables is 10 percent. If the electronic claims system costs $30,000 a year to lease and operate, should it be adopted? (Assume that the entire receivables balance has to be financed.)

4. Seattle Health Plans currently uses zero debt financing. Its operating profit is Si million, and it pays taxes at a 40 percent rate. It has $5 million in assets and, because it is all-equity financed, S5 million in equity. Suppose the firm is considering replacing half of its equity financing with debt financing that bears an interest rate of 8 percent. a. What impact would the new capital structure have on the firm's profit, total dollar return to investors, and return on equity? b. Redo the analysis, but now assume that the debt financing would cost 15 percent. c. Repeat the analysis required for Part a, but now assume that Seattle Health Plans is a not-for-profit corporation and hence pays no taxes. Compare the results with those obtained in Part a. 5. Calculate the effective (after-tax) cost of debt for Wallace Clinic, a for-profit healthcare provider, assuming that the interest rate set on its debt is it percent and its tax rate is a. 0 percent b. 20 percent c. 40 percent

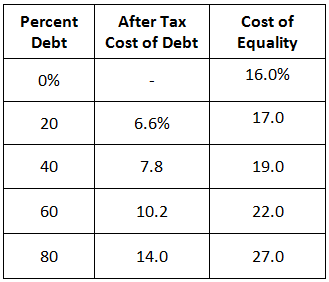

6. St. Vincent's Hospital has a target capital structure of 35 percent debt and 65 percent equity. Its cost of equity estimate is 13.5 percent and its cost of tax-exempt debt estimate is 7 percent. What is the hospital's corporate cost of capital? 7. Richmond Clink has obtained the following estimates for its costs of debt and equity at various capital structures:  What is the firm's optimal capital structure? (Hint: Calculate its corporate cost of capital at each structure. Also, note that data on component costs at alternative capital structures are not reliable in real-world situations) 8. Morningside Nursing Home, a not-for-profit corporation, is estimating its corporate cost of capital. Its tax-exempt debt currently requires an interest rate of 6.2 percent, and its target capital structure calls for 6o percent debt financing and 40 percent equity (fund capital) financing. Its estimated cost of equity is t6.4 percent. What is Morningside's corporate cost of capital?

What is the firm's optimal capital structure? (Hint: Calculate its corporate cost of capital at each structure. Also, note that data on component costs at alternative capital structures are not reliable in real-world situations) 8. Morningside Nursing Home, a not-for-profit corporation, is estimating its corporate cost of capital. Its tax-exempt debt currently requires an interest rate of 6.2 percent, and its target capital structure calls for 6o percent debt financing and 40 percent equity (fund capital) financing. Its estimated cost of equity is t6.4 percent. What is Morningside's corporate cost of capital?

Revenues Costs Profits Simple Budget $ 4.7 4.1 0.6 Flexible Budget $ 4.8 4.1 0.7 Actual Results $4.5 4.2 0.3 Numbers of Surgeries Patient Revenue Salary Expense Nonsalary Expense Profit Simple Budget 1,200 $2,400 $1,200 $600 $ 600 Flexible Budget 1,300 $ 2,600 $1,300 $650 $ 650 Actual Results 1,300 $2,535 $1,365 $585 $ 585 Percent Debt 0% 20 40 60 80 After Tax Cost of Debt 6.6% 7.8 10.2 14.0 Cost of Equality 16.0% 17.0 19.0 22.0 27.0

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Lets tackle each question one by one Question 1 Newark General Hospital Variance Analysis a Calculate the Two Profit Variances 1 Static Budget Variance SBV textSBV textActual Profit textSimple Budget ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

6097e584e850b_28288.pdf

180 KBs PDF File

6097e584e850b_28288.docx

120 KBs Word File