Domino Company uses the aging of accounts receivables method to estimate uncollectible accounts expense. Domino began year

Fantastic news! We've Found the answer you've been seeking!

Question:

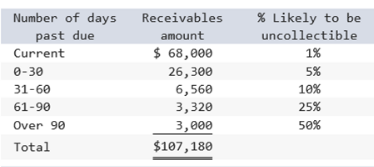

Domino Company uses the aging of accounts receivables method to estimate uncollectible accounts expense. Domino began year 2 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $34,430 and $3,380, respectively. During the year, the company wrote off $2,590 in uncollectible accounts. In preparation for the company?s Year 2 estimate. Domino prepared the following aging schedule:

What will Domino record as Uncollectible Accounts Expense for Year 2?

Multiple Choice

a. $4,191

b. $1,601

c. $4,981

d. $2,590

Related Book For

Accounting Principles

ISBN: 978-0470534793

10th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Posted Date: