Question: ************************************* - - - - ************************************* - - - - Required information [The following information applies to the questions displayed below.] The transactions listed below

*************************************

-

-

-

-

![information [The following information applies to the questions displayed below.] The transactions](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e820bfdc37f_76766e820bf574ed.jpg)

*************************************

-

-

-

-

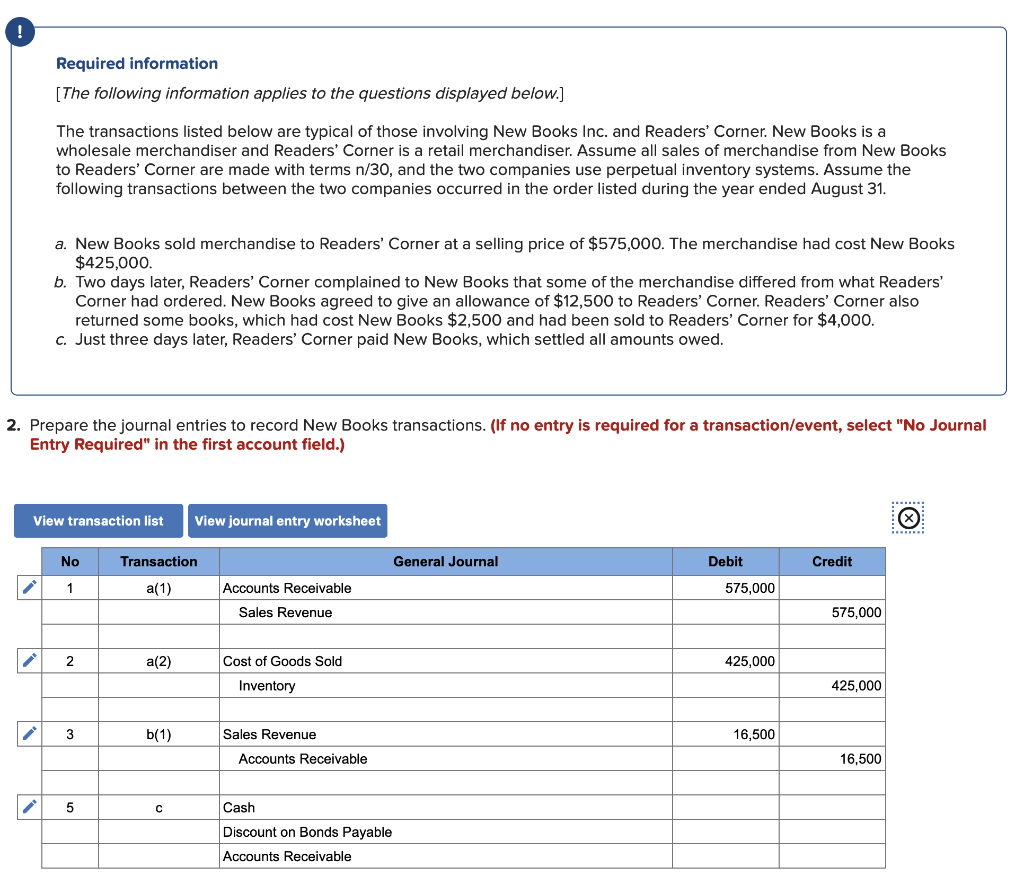

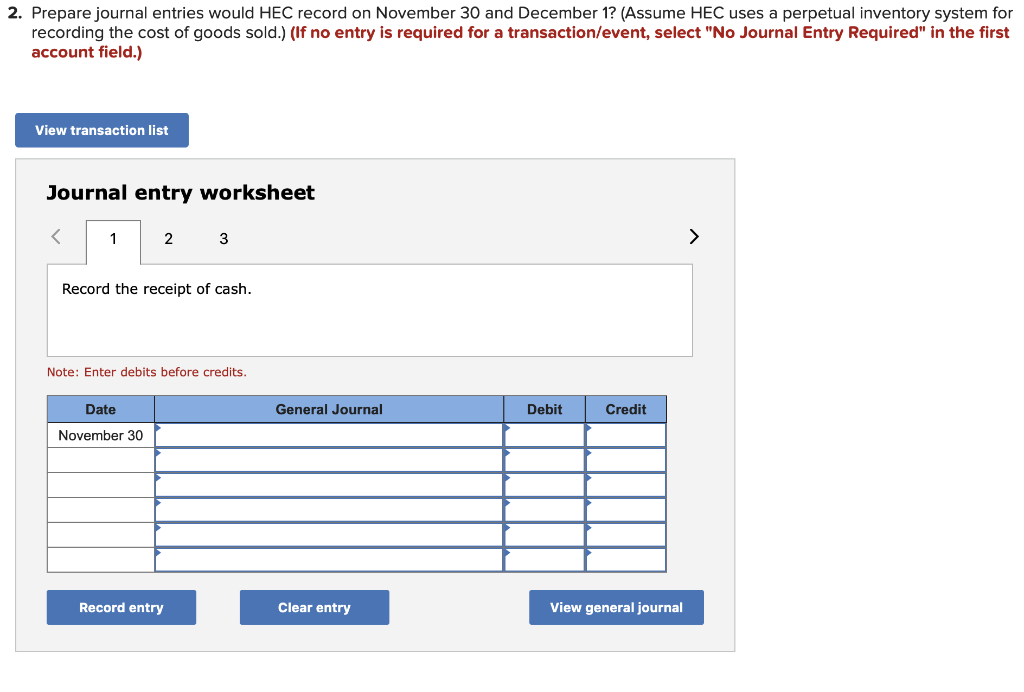

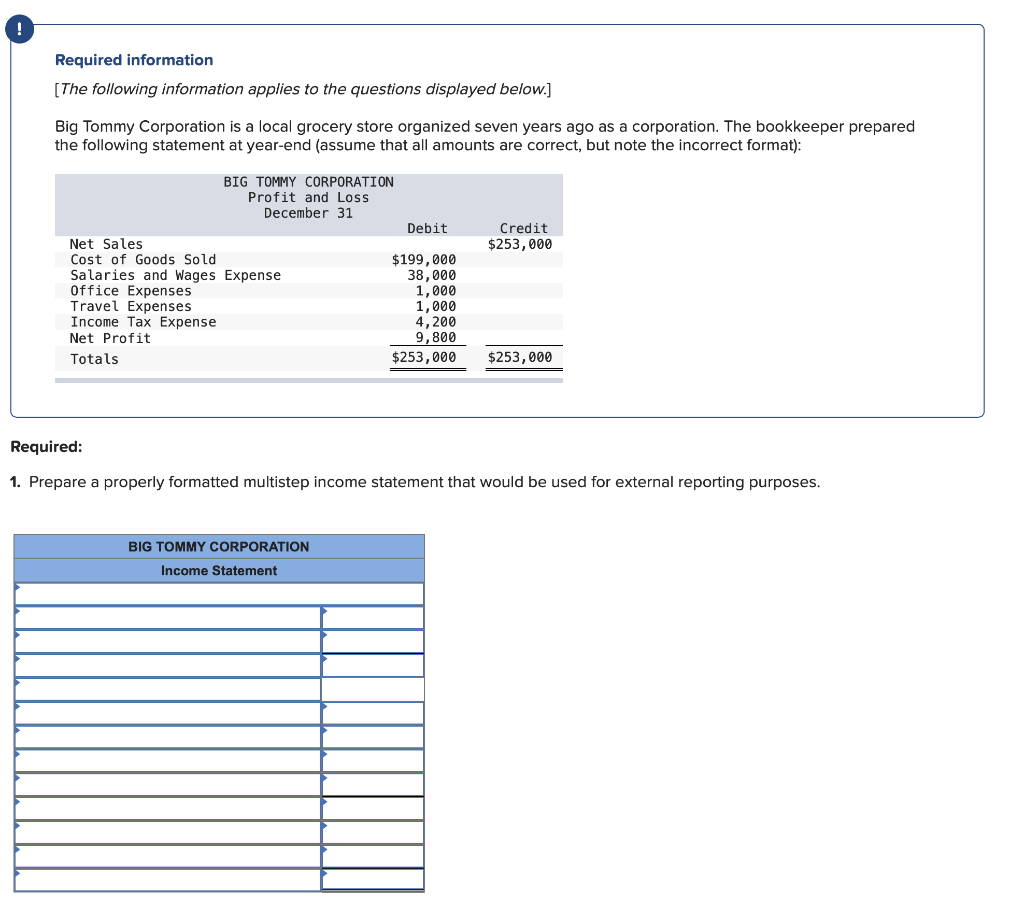

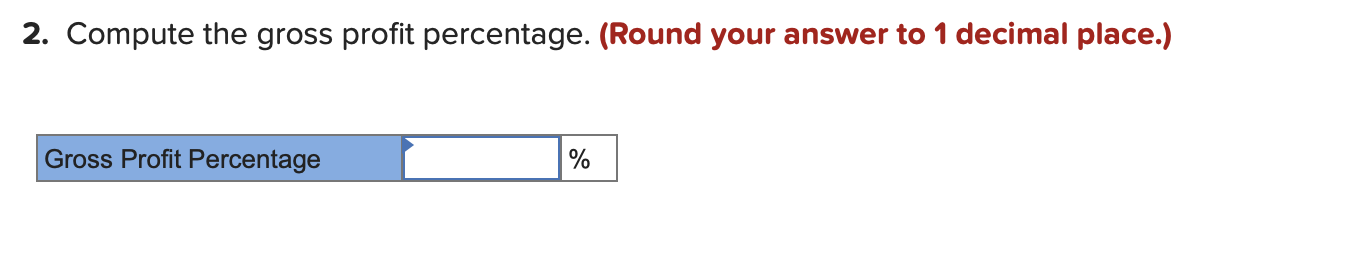

Required information [The following information applies to the questions displayed below.] The transactions listed below are typical of those involving New Books Inc. and Readers' Corner. New Books is a wholesale merchandiser and Readers' Corner is a retail merchandiser. Assume all sales of merchandise from New Books to Readers' Corner are made with terms n/30, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended August 31. a. New Books sold merchandise to Readers' Corner at a selling price of $575,000. The merchandise had cost New Books $425,000. b. Two days later, Readers' Corner complained to New Books that some of the merchandise differed from what Readers' Corner had ordered. New Books agreed to give an allowance of $12,500 to Readers' Corner. Readers' Corner also returned some books, which had cost New Books $2,500 and had been sold to Readers' Corner for $4,000. C. Just three days later, Readers' Corner paid New Books, which settled all amounts owed. 2. Prepare the journal entries to record New Books transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet X No Transaction General Journal Debit Credit 1 a(1) 575,000 Accounts Receivable Sales Revenue 575,000 2 a(2) Cost of Goods Sold 425,000 Inventory 425,000 3 b(1) Sales Revenue 16,500 Accounts Receivable 16,500 5 Cash Discount on Bonds Payable Accounts Receivable Required information [The following information applies to the questions displayed below.] Hospital Equipment Company (HEC) acquired several fMRI machines for its inventory at a cost of $3,400 per machine. HEC usually sells these machines to hospitals at a price of $5,950. HEC also separately sells 12 months of training and repair services for fMRI machines for $2,550. HEC is paid $5,950 cash on November 30 for the sale of an fMRI machine delivered on December 1. HEC sold the machine at its regular price, but included one year of free training and repair service. Required: 1. For the machine sold at its regular price, but with one year of "free" training and repair service, determine the dollar amount of revenue earned from the equipment sale versus the revenue earned from the training and repair services. Allocated Transaction Price Equipment Service 2. Prepare journal entries would HEC record on November 30 and December 1? (Assume HEC uses a perpetual inventory system for recording the cost of goods sold.) (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the receipt of cash. Note: Enter debits before credits. Date General Journal Debit Credit November 30 Record entry Clear entry View general journal Required information [The following information applies to the questions displayed below.] Big Tommy Corporation is a local grocery store organized seven years ago as a corporation. The bookkeeper prepared the following statement at year-end (assume that all amounts are correct, but note the incorrect format): BIG TOMMY CORPORATION Profit and Loss December 31 Debit Credit $253,000 Net Sales Cost of Goods Sold Salaries and Wages Expense Office Expenses Travel Expenses Income Tax Expense Net Profit Totals $199,000 38,000 1,000 1,000 4,200 9,800 $253,000 $253,000 Required: 1. Prepare a properly formatted multistep income statement that would be used for external reporting purposes. BIG TOMMY CORPORATION Income Statement 2. Compute the gross profit percentage. (Round your answer to 1 decimal place.) Gross Profit Percentage %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts