Question: ----------------------- ------------------------------------------------ ------------------------------------------------------------- ------------------------------------------------------------------------------------- ----------------------------------------------- ------------------------------------- ------------------------------------- --------------------------------------------------------------------- ----------------------------------------------- ------------------------------------------------------- Assume the following information for a company that produced 10,000 units and sold 8,000 units

-----------------------

------------------------------------------------

-------------------------------------------------------------

-------------------------------------------------------------------------------------

-----------------------------------------------

-------------------------------------

-------------------------------------

---------------------------------------------------------------------

-----------------------------------------------

-------------------------------------------------------

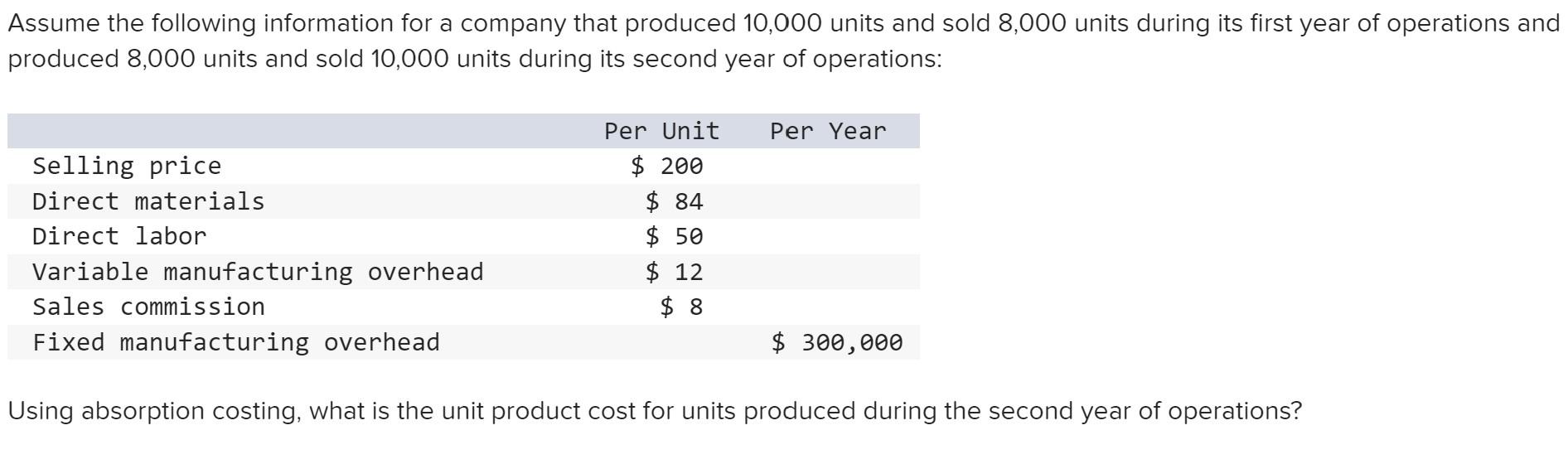

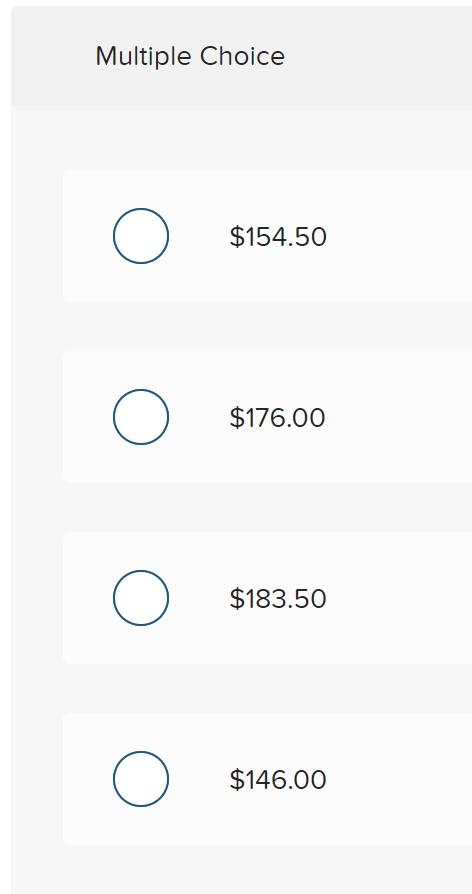

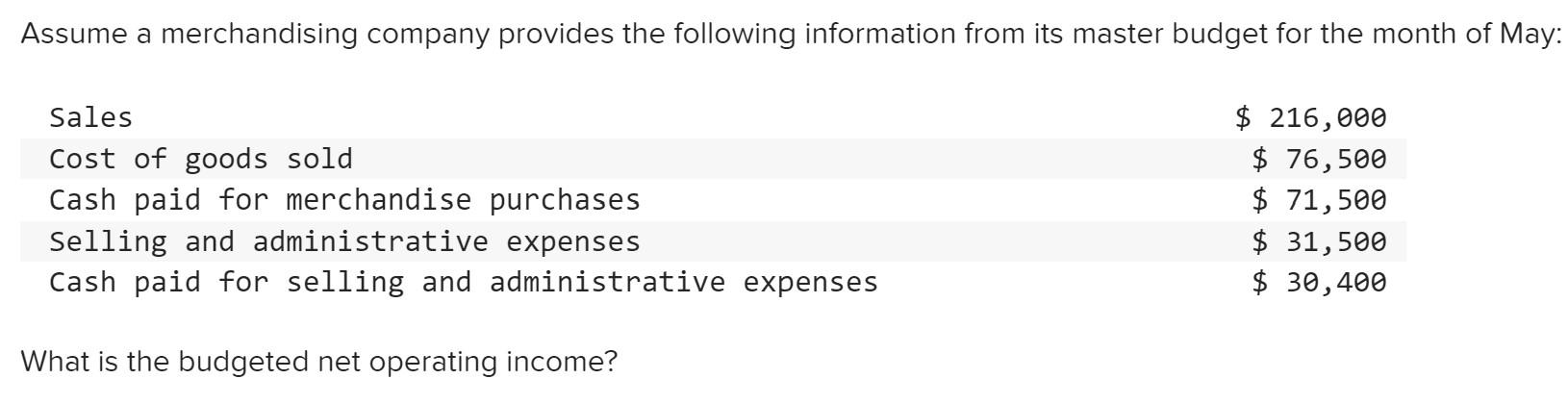

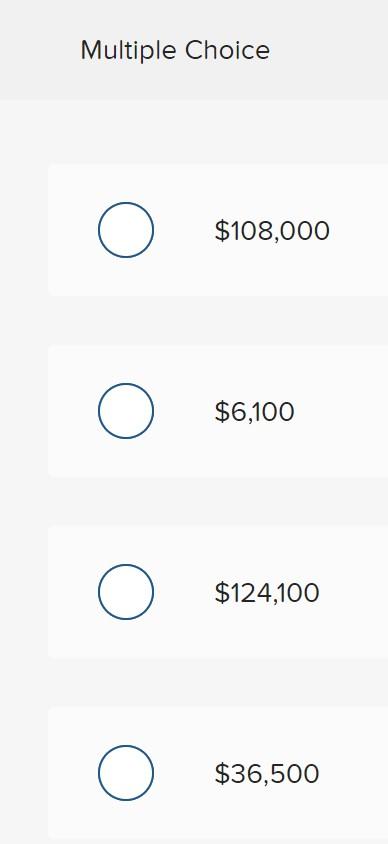

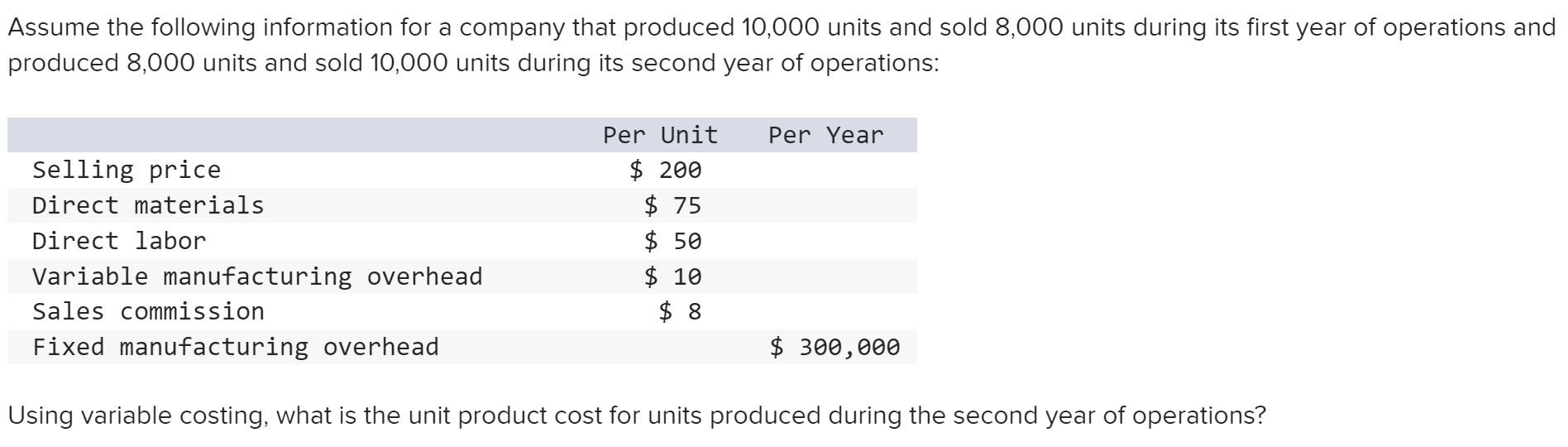

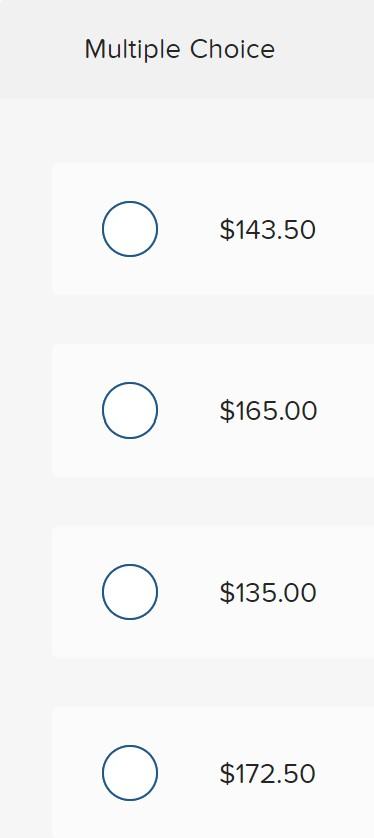

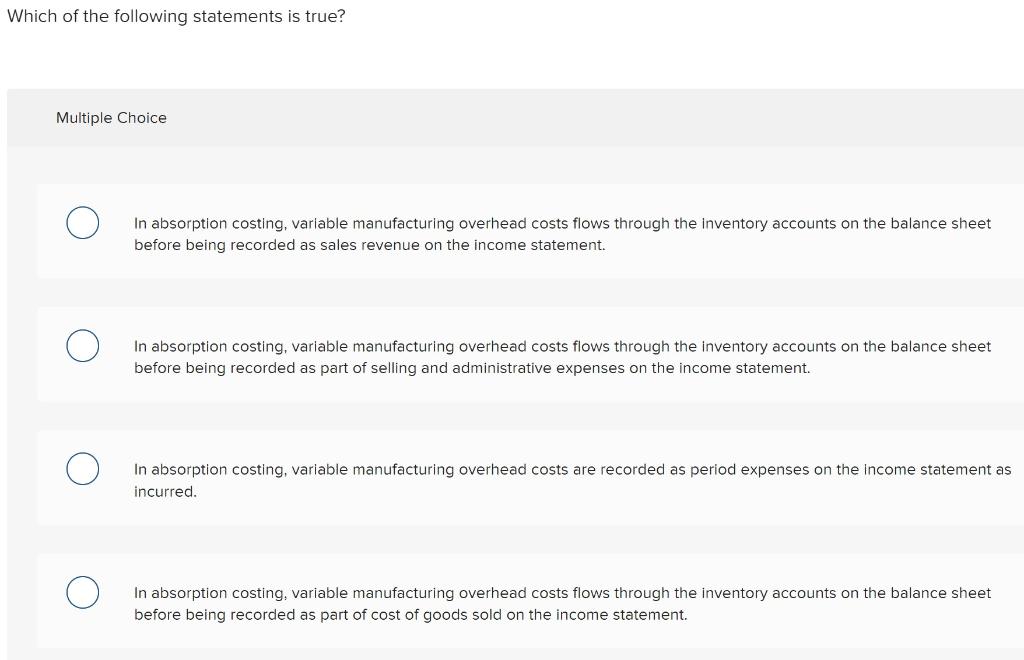

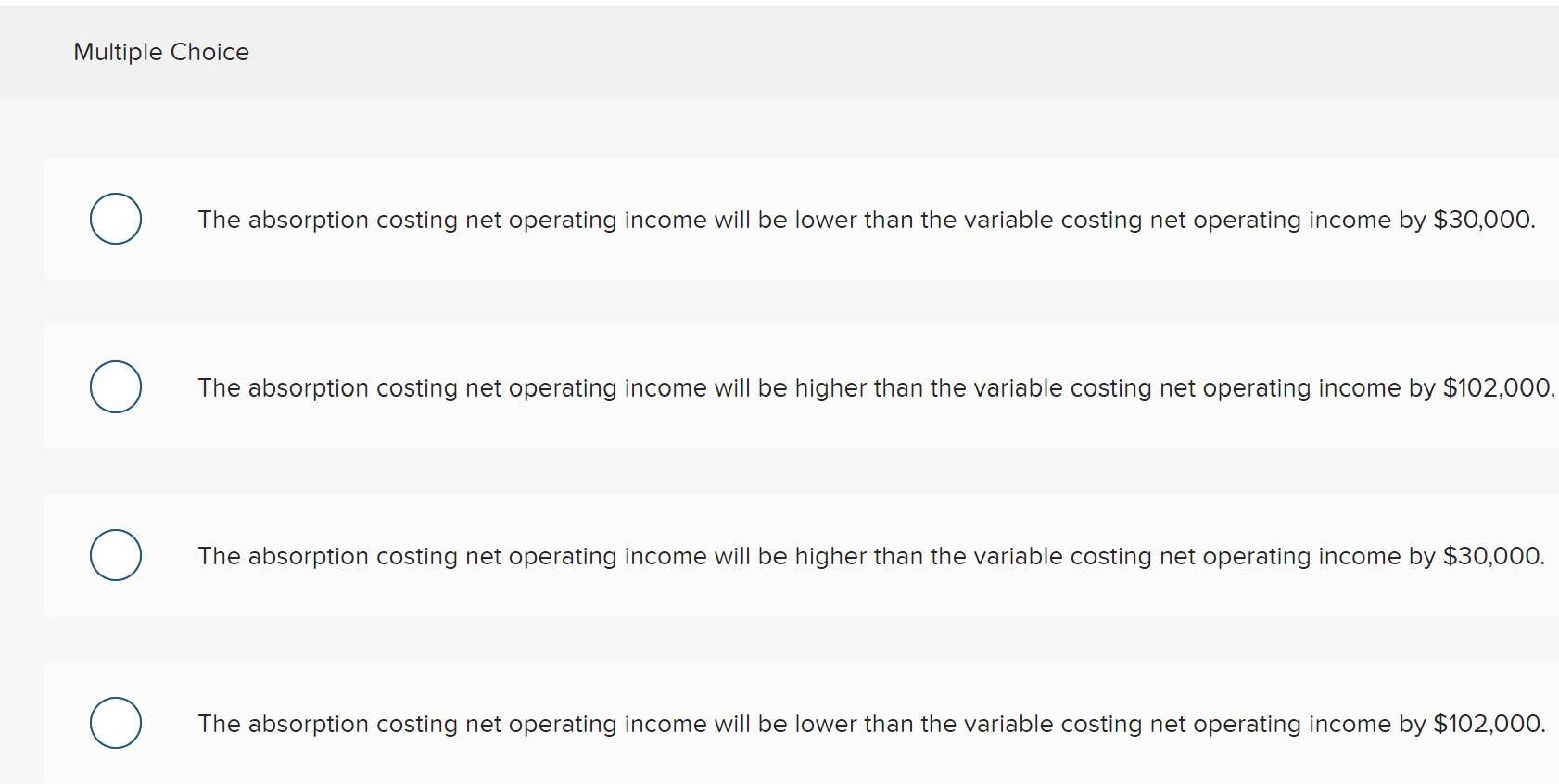

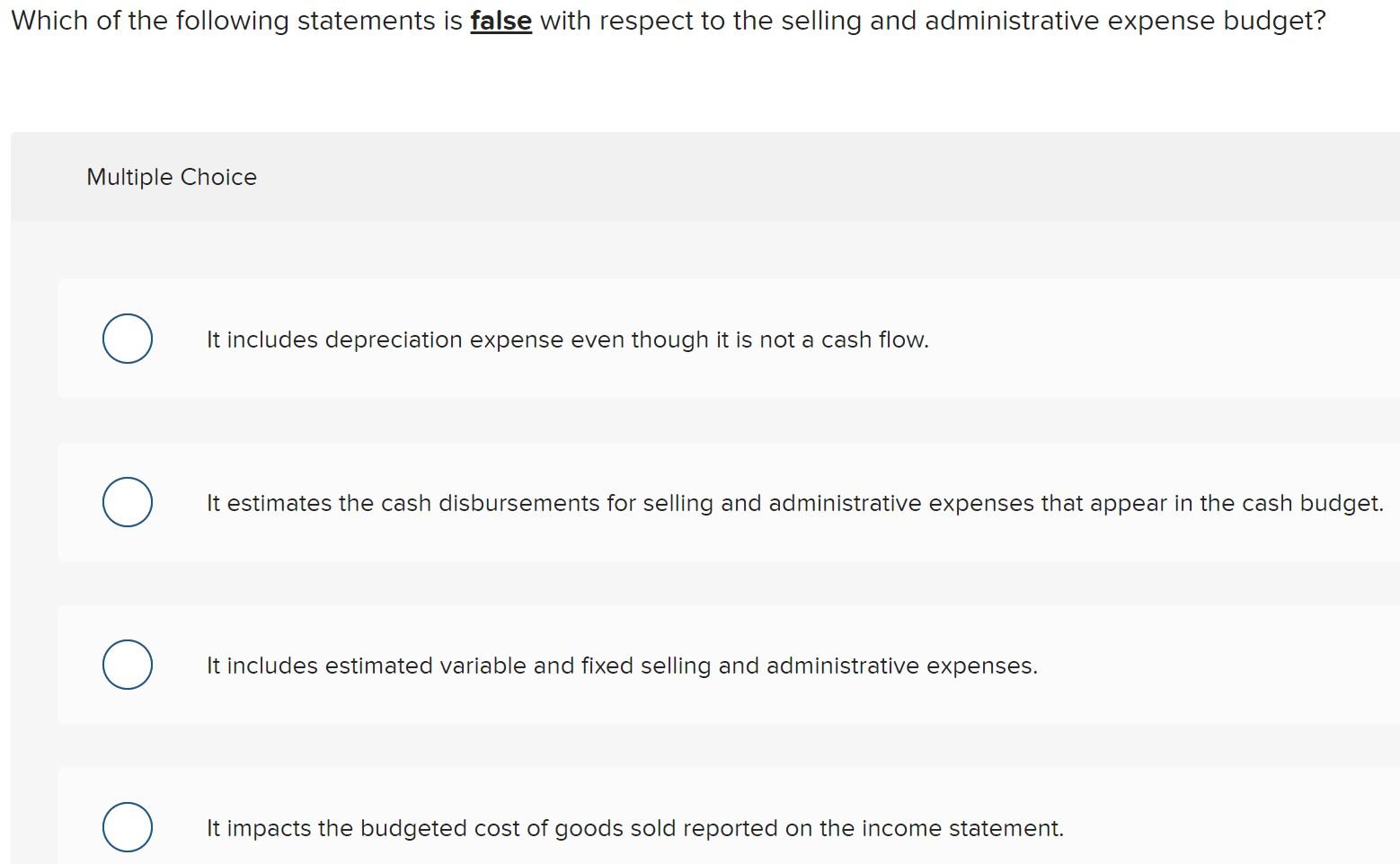

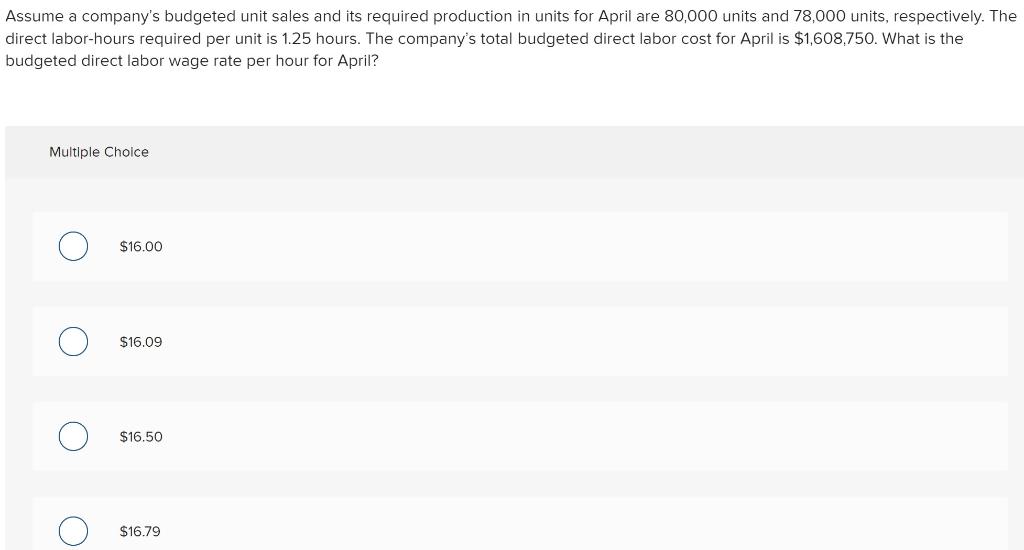

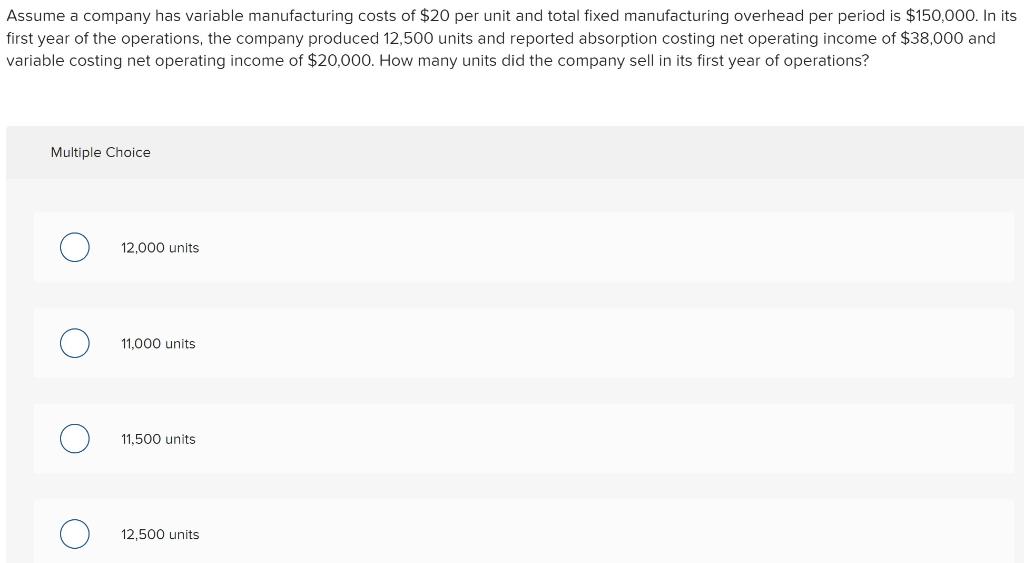

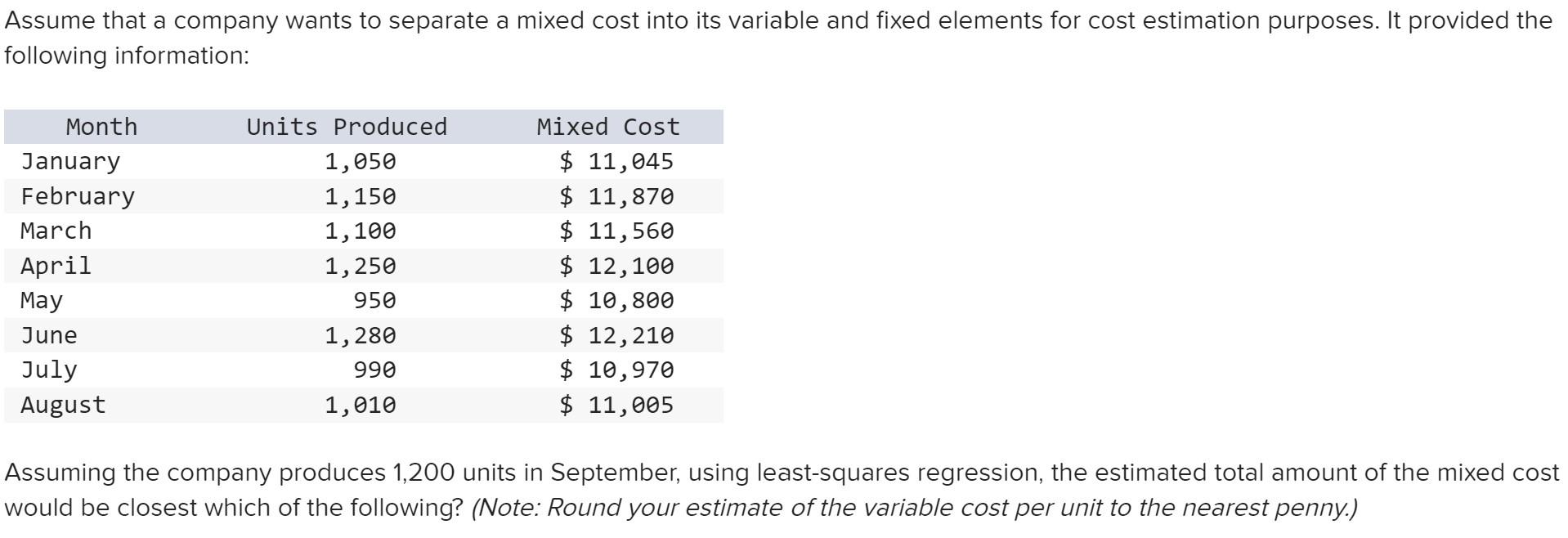

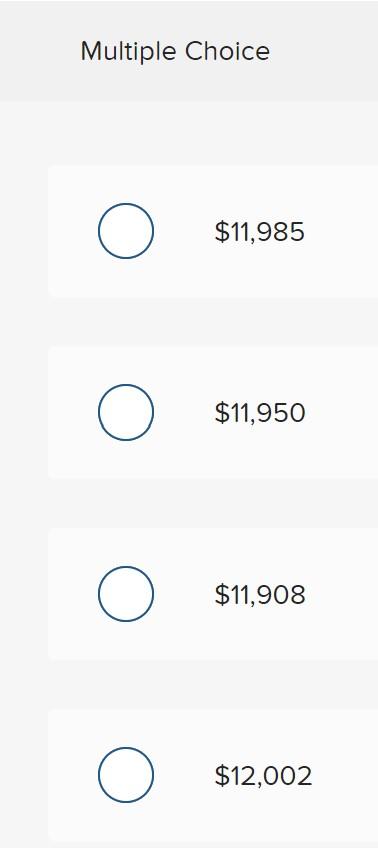

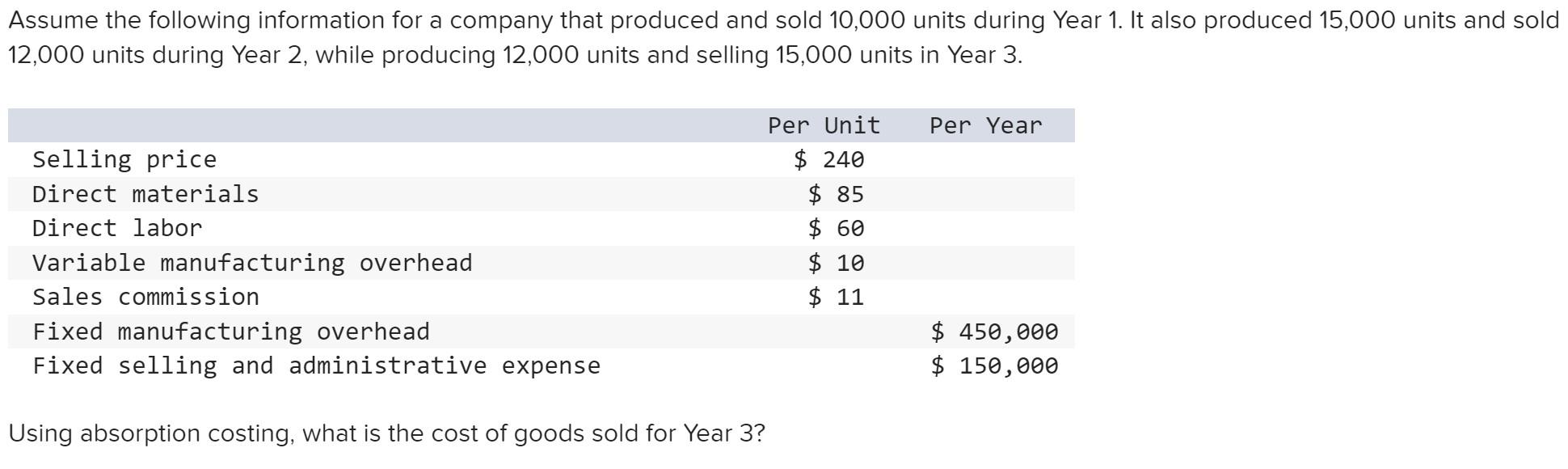

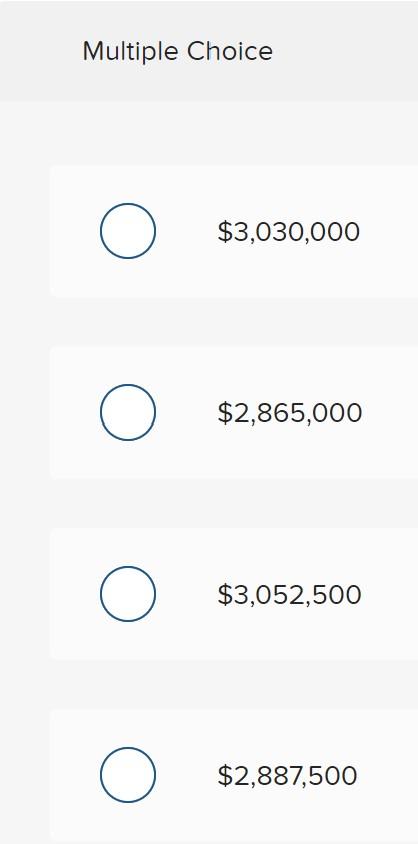

Assume the following information for a company that produced 10,000 units and sold 8,000 units during its first year of operations and produced 8,000 units and sold 10,000 units during its second year of operations: Per Year Selling price Direct materials Direct labor Variable manufacturing overhead Sales commission Fixed manufacturing overhead Per Unit $ 200 $ 84 $ 50 $ 12 $ 8. $ 300,000 Using absorption costing, what is the unit product cost for units produced during the second year of operations? Multiple Choice $154.50 $176.00 O $183.50 O $146.00 Assume a merchandising company provides the following information from its master budget for the month of May: Sales Cost of goods sold Cash paid for merchandise purchases Selling and administrative expenses Cash paid for selling and administrative expenses $ 216,000 $ 76,500 $ 71,500 $ 31,500 $ 30,400 What is the budgeted net operating income? Multiple Choice O $108,000 $6,100 $124,100 $36,500 Assume the following information for a company that produced 10,000 units and sold 8,000 units during its first year of operations and produced 8,000 units and sold 10,000 units during its second year of operations: Per Year Selling price Direct materials Direct labor Variable manufacturing overhead Sales commission Fixed manufacturing overhead Per Unit $ 200 $ 75 $ 50 $ 10 $ 8 $ 300,000 Using variable costing, what is the unit product cost for units produced during the second year of operations? Multiple Choice O $143.50 (0) $165.00 $135.00 $172.50 Which of the following statements is true? Multiple Choice In absorption costing, variable manufacturing overhead costs flows through the inventory accounts on the balance sheet before being recorded as sales revenue on the income statement. In absorption costing, variable manufacturing overhead costs flows through the inventory accounts on the balance sheet before being recorded as part of selling and administrative expenses on the income statement. In absorption costing, variable manufacturing overhead costs are recorded as period expenses on the income statement as incurred. In absorption costing, variable manufacturing overhead costs flows through the inventory accounts on the balance sheet before being recorded as part of cost of goods sold on the income statement. Assume the following information for a company that produced 10,000 units and sold 9,000 units during its first year of operations: Per Year Selling price Direct materials Direct labor Variable manufacturing overhead Sales commission Fixed manufacturing overhead Per Unit $ 200 $ 75 $ 50 $ 10 $ 8 $ 300,000 Which of the following choices explains the relationship between the absorption costing net operating income and the variable costing net operating income? Multiple Choice The absorption costing net operating income will be lower than the variable costing net operating income by $30,000. The absorption costing net operating income will be higher than the variable costing net operating income by $102,000. The absorption costing net operating income will be higher than the variable costing net operating income by $30,000. The absorption costing net operating income will be lower than the variable costing net operating income by $102,000. Which of the following statements is false with respect to the selling and administrative expense budget? Multiple Choice It includes depreciation expense even though it is not a cash flow. It estimates the cash disbursements for selling and administrative expenses that appear in the cash budget. It includes estimated variable and fixed selling and administrative expenses. It impacts the budgeted cost of goods sold reported on the income statement. Assume a company's budgeted unit sales and its required production in units for April are 80,000 units and 78,000 units, respectively. The direct labor-hours required per unit is 1.25 hours. The company's total budgeted direct labor cost for April is $1,608,750. What is the budgeted direct labor wage rate per hour for April? Multiple Choice O $16.00 O $16.09 O $16.50 O $16.79 Assume a company has variable manufacturing costs of $20 per unit and total fixed manufacturing overhead per period is $150,000. In its first year of the operations, the company produced 12,500 units and reported absorption costing net operating income of $38,000 and variable costing net operating income of $20,000. How many units did the company sell in its first year of operations? Multiple Choice 12.000 units 11.000 units O 11.500 units O 12,500 units Assume that a company wants to separate a mixed cost into its variable and fixed elements for cost estimation purposes. It provided the following information: Month January February March April May June July August Units Produced 1,050 1,150 1,100 1,250 Mixed Cost $ 11,045 $ 11,870 $ 11,560 $ 12,100 $ 10,800 $ 12,210 $ 10,970 $ 11,005 950 1,280 990 1,010 Assuming the company produces 1,200 units in September, using least-squares regression, the estimated total amount of the mixed cost would be closest which of the following? (Note: Round your estimate of the variable cost per unit to the nearest penny.) Multiple Choice $11,985 $11,950 $11,908 $12,002 Assume the following information for a company that produced and sold 10,000 units during Year 1. It also produced 15,000 units and sold 12,000 units during Year 2, while producing 12,000 units and selling 15,000 units in Year 3. Per Year Selling price Direct materials Direct labor Variable manufacturing overhead Sales commission Fixed manufacturing overhead Fixed selling and administrative expense Per Unit $ 240 $ 85 $ 60 $ 10 $ 11 $ 450,000 $ 150,000 Using absorption costing, what is the cost of goods sold for Year 3? Multiple Choice O $3,030,000 $2,865,000 $3,052,500 $2,887,500 Which of the following explains how to prepare a profit graph? Multiple Choice Compute the contribution margin ratio at two different sales volumes, plot the points, and then connect them with a straight line. Compute the total variable expenses at two different sales volumes, plot the points, and then connect them with a straight line. Compute the contribution margin at two different sales volumes, plot the points, and then connect them with a straight line. Compute the profit at two different sales volumes, plot the points, and then connect them with a straight line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts